- UK/USA Tax & estate planning

Shorter Reads

How do I solve my transatlantic inheritance tax problem?

1 minute read

Published 15 January 2020

Key information

- Specialisms

- Private Wealth

- Services

- UK/USA Tax & estate planning

I am a US citizen who has lived in the UK for nearly 20 years. As an only child I stand to inherit significant assets from my elderly mother, who has most of her money in individual retirement accounts in the US. She is in poor health and has asked me to take over her financial affairs.

Can I avoid paying over the odds in both US and UK taxes when I inherit? I want to distribute some of the money to my two children, who are dual UK/US citizens, as well as maximise the growth of the remaining assets.

With cross-border issues you should always take legal and investment advice in both

jurisdictions; a tax planning opportunity in one may have an unwanted tax consequence in the other.

You and your children are liable to all UK taxes on your worldwide estates and on your worldwide income and capital gains as they arise. This is because you are either UK domiciled, or (in your case) because you have been UK resident for more than 15 consecutive tax years and so are deemed UK domiciled. Similarly, we understand that, as US citizens, you are all liable to US taxes on a worldwide basis as well.

If your mother’s total wealth is under the available lifetime US estate tax allowance (currently $11.4m) then we understand that she can leave these assets free from US taxes.

For UK income tax purposes, individual retirement accounts (IRAs) are treated as pensions under the US/UK double tax treaty and so you and/or your children will be liable to UK tax on distributions out of the IRA. As you are UK resident, it is possible for an IRA to be managed by a suitably qualified UK-based investment manager, but the IRA account itself must be held in the US, for example with a custody bank.

Finally, if you are due to inherit substantial assets from your mother it is important that you have a tax-efficient will. Drafted correctly, you should be able to avoid IHT and US estate tax on the first death of either you or your partner.

As you and your children are US/UK taxpayers, both jurisdictions will often tax you on the same assets. Under the US/UK double tax treaty one jurisdiction will have primary taxing rights, and the other jurisdiction will often allow a credit for tax paid in the primary jurisdiction. When submitting your US and UK tax returns you should ensure that you apply for foreign tax credits wherever applicable.

As a second pitfall, rather than holding assets outright in her own name, your mother may hold some of her assets through a US “living trust”. This form of trust can be a common US estate planning tool to avoid the costs and complexities of US probate but, depending on the form of trust, these types of trust risk storing up a potential UK tax charge when the assets are distributed to you following your mother’s death.

This article was originally published in the Financial Times on 14 January 2020: https://www.ft.com/content/f8bf558d-8236-4ee8-9911-4bdca347fe46

Related content

Shorter Reads

How do I solve my transatlantic inheritance tax problem?

Published 15 January 2020

Associated sectors / services

Authors

I am a US citizen who has lived in the UK for nearly 20 years. As an only child I stand to inherit significant assets from my elderly mother, who has most of her money in individual retirement accounts in the US. She is in poor health and has asked me to take over her financial affairs.

Can I avoid paying over the odds in both US and UK taxes when I inherit? I want to distribute some of the money to my two children, who are dual UK/US citizens, as well as maximise the growth of the remaining assets.

With cross-border issues you should always take legal and investment advice in both

jurisdictions; a tax planning opportunity in one may have an unwanted tax consequence in the other.

You and your children are liable to all UK taxes on your worldwide estates and on your worldwide income and capital gains as they arise. This is because you are either UK domiciled, or (in your case) because you have been UK resident for more than 15 consecutive tax years and so are deemed UK domiciled. Similarly, we understand that, as US citizens, you are all liable to US taxes on a worldwide basis as well.

If your mother’s total wealth is under the available lifetime US estate tax allowance (currently $11.4m) then we understand that she can leave these assets free from US taxes.

For UK income tax purposes, individual retirement accounts (IRAs) are treated as pensions under the US/UK double tax treaty and so you and/or your children will be liable to UK tax on distributions out of the IRA. As you are UK resident, it is possible for an IRA to be managed by a suitably qualified UK-based investment manager, but the IRA account itself must be held in the US, for example with a custody bank.

Finally, if you are due to inherit substantial assets from your mother it is important that you have a tax-efficient will. Drafted correctly, you should be able to avoid IHT and US estate tax on the first death of either you or your partner.

As you and your children are US/UK taxpayers, both jurisdictions will often tax you on the same assets. Under the US/UK double tax treaty one jurisdiction will have primary taxing rights, and the other jurisdiction will often allow a credit for tax paid in the primary jurisdiction. When submitting your US and UK tax returns you should ensure that you apply for foreign tax credits wherever applicable.

As a second pitfall, rather than holding assets outright in her own name, your mother may hold some of her assets through a US “living trust”. This form of trust can be a common US estate planning tool to avoid the costs and complexities of US probate but, depending on the form of trust, these types of trust risk storing up a potential UK tax charge when the assets are distributed to you following your mother’s death.

This article was originally published in the Financial Times on 14 January 2020: https://www.ft.com/content/f8bf558d-8236-4ee8-9911-4bdca347fe46

Associated sectors / services

- UK/USA Tax & estate planning

Authors

Need some more information? Make an enquiry below.

Subscribe

Please add your details and your areas of interest below

Article contributor

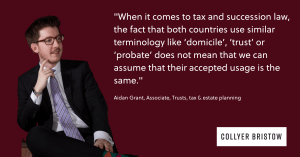

Aidan

GrantPartner

Specialising in International trusts, tax & estate planning, Private wealth, UK trusts, tax & estate planning and US/UK Tax & estate planning

Enjoy reading our articles? why not subscribe to notifications so you’ll never miss one?

Subscribe to our articlesMessage us on WhatsApp (calling not available)

Please note that Collyer Bristow provides this service during office hours for general information and enquiries only and that no legal or other professional advice will be provided over the WhatsApp platform. Please also note that if you choose to use this platform your personal data is likely to be processed outside the UK and EEA, including in the US. Appropriate legal or other professional opinion should be taken before taking or omitting to take any action in respect of any specific problem. Collyer Bristow LLP accepts no liability for any loss or damage which may arise from reliance on information provided. All information will be deleted immediately upon completion of a conversation.

Close