The Team

Our lawyers have the expertise and experience to provide you with creative, personalised solutions in a clear and understandable way.

Our Publications

Discover a wealth of invaluable guidance in the form of guides and brochures written by our expert lawyers.

Hybrid working - knowledge hub

Although flexible and agile working have been buzzwords in employment law for a few years now, the pandemic has forced it onto the agenda of all organisations, whatever their size, structure, sector or location.

Helping employers manage statutory flexible working requests

About

Pragmatic advice to move your business forward

Our Employment Lawyers have the expertise and experience to help you navigate and adapt to the changing landscape and provide innovative solutions. We work closely with many types of clients across a wide range of sectors providing advice on a variety of issues, whether they are HR-related, strategic, complex or contentious.

We get to know your business, working practices, culture and commercial objectives. This enables us to provide tailored and pragmatic advice to help your organisation move forward and minimise HR headaches and disruption. Where possible we promote the early resolution of employment disputes but, when this cannot be achieved, we guide you through the litigation process with a commitment to delivering the best possible result for your business.

Our Employment team provides both a highly proactive and pragmatic client service and is experienced in all aspects of employment law.

Our immigration team offers a personal and tailored service to businesses and private clients. With a thorough knowledge of the UK immigration rules and by gaining a full understanding of your unique circumstances and priorities, we can determine the route which best fits your requirements from across the UK visa tiers. We then guide you practically and pragmatically through the immigration process, also advising on any relevant tax planning implications.

Tania GoodmanPartner - Head of Employment

+44 20 7470 4528+44 7943 827603tania.goodman@collyerbristow.com

Services

We support our clients with individually tailored legal advice, in areas such as:

- Recruitment Law

- TUPE

- Restructuring & Redundancy

- Employee Consultation

- Diversity & Discrimination

- Flexible working

- Governance Issues

- NED Contracts

- LTIPS and Bonus Schemes

- Dismissals

- Settlement Agreements

- Employment Contracts

- Confidentiality Agreements

- Policies and Staff Handbooks

- Employee Relations

- Trade Union Recognition

- Gig Economy Issues

- Industrial Action

- Works Councils / Employee Forums

- Employment Tribunal Proceedings

- IR35 Guidance

Recruitment Law

Employees are a valuable asset for any business and your relationship with them starts from the very first job advertisement. Creating an effective hiring and selection policy, in full accordance with recruitment law, makes it easier to recruit a well-structured team and avoid making harmful or potentially discriminatory decisions.

What legal issues do employers face in recruitment?

Our specialist recruitment law solicitors can help protect your rights from the very first interaction. Common issues include:

- Lengthy and complex recruitment processes that are rife with discrimination risks

- Understanding which ‘positive action’ steps can be lawfully taken to encourage candidates from under-represented groups

- Overcoming bias during the screening and interview process

- The legalities of choosing a candidate who has a protected characteristic over one who does not

- Diversity and discrimination in recruitment law

- Right to work laws if you are recruiting candidates from overseas

- Recruitment outsourcing and agency disputes

- Recruiting gig economy workers and contractors within or outside IR35

How can our recruitment law team help?

Our recruitment law team has a real understanding of the commercial needs of your business and we deliver our advice accordingly. We can advise on one-time issues or act as an extension of your HR team, offering robust recruitment support on legislation to ensure your business is compliant of your obligations during each stage of the recruitment process.

Should a dispute arise in regards to recruitment, we can give you the best legal representation, taking claims to the Employment Tribunal and to court where appropriate. We have a reputation for offering fast, creative solutions to recruitment disputes. It’s our job to minimise disruption to your business so that you can concentrate on recruiting the best candidate for your job.

TUPE

The Transfer of Undertakings (Protection of Employment) Regulations 2006 protects employee rights if a business changes ownership and during other types of restructuring. They give several duties to both the old employer and the new one. Failure to perform these duties could lead to an expensive Employment Tribunal claim. We help employers avoid the risks associated with a business transfer. Our specialist TUPE team can help you tick all the boxes so the transfer goes ahead with the best possible protection for your business.

What issues might employers face under TUPE?

The TUPE Regulations are a complex beast and there is a lot to consider if you are to avoid a costly legal dispute. The main thrust of the legislation is to shift employees – and all liabilities associated with them – to the new employer. To protect your business from claims, you need to understand when TUPE applies, what you have to do to comply with the Regulations, what steps you can take to protect your business from claims, and the penalties that apply if things go wrong.

Tricky issues that can often trip employers up include:

- Disagreements as to which employees should transfer under TUPE

- The correction of liabilities such as national minimum wage underpayments

- Harmonising terms in employment contracts of staff after a TUPE transfer, especially where some employees have generous share or profit-sharing schemes

- Permitted changes to employment contracts for ‘economical, technical or organisational’ (ETO) reasons

- Trade union consultations

- Dismissals and redundancies

- Failure to comply with due diligence disclosures

- The enforcement of restrictive covenants after a TUPE transfer

How can we help?

Knowing when and how TUPE applies to your situation is the first step to being compliant. We can help you negotiate the TUPE clauses in your employment contract, manage the consultation process, draft letters to employees, support you through redundancies and defend claims made to Employment Tribunals or through the courts.

Our team consists of transactional and contentious disputes lawyers. Together, our employment lawyers can ensure that you not only avoid and quickly resolve any disputes under TUPE, but you also have the ongoing support you need after the transfer as you streamline operations and focus on growth.

Restructuring & Redundancy

It is a tough decision to relocate or demote employees or make them redundant. But if you are closing down a branch, consolidating operations, or moving to a new site, then a certain number of job adjustments may be inevitable. Our Employment Lawyers can protect your business from any claim arising from a change in organisational structure, including post-restructuring grievance proceedings from employees who are unhappy in their new roles.

What is the redundancy process?

The role must be disappearing for there to be a true redundancy situation. Normally, that will be because:

- The business is closing

- A site or workplace is closing down or moving

- You no longer need as many workers to do a particular type of work, e.g because of new technology

The process itself includes a consultation with individual employees before making any final decisions. If you are planning to make 20 or more employees redundant within a 90-day period, you’ll also have to consult with a trade union or staff council/employee forum. Employers must act reasonably and be able to justify the selection of the pool of employees they will be using when choosing who to make redundant.

What is suitable alternative employment in redundancy?

Specifically, in a restructuring situation, employers will be looking to make efficient use of their employees by offering ‘suitable alternative employment’ to an employee whose job is no longer needed, but who you wish to retain after the reorganisation.

By law, the test for whether an alternative role is suitable is largely a subjective one. In other words, the employee can decline the offer and opt for redundancy if the new role would, for example, lead to longer travelling times, upset childcare commitments, require retraining, or impose extra costs on the employee.

When conflict arises, it’s usually because:

- The employee believes the offer of alternative employment was not suitable

- The employer believes the employee was unreasonable in refusing the alternative work

- An employer is trying to change an employee’s job role without their consent

- An employee feels like they were discriminated against or not given a fair chance at an interview for a new role

How can our redundancy lawyers help?

Whatever the nature of the restructuring and redundancy dispute, it is wise to try to prevent it from escalating to an Employment Tribunal. Many potential conflicts can be headed off at the pass through a proper consultation procedure where employees are involved in the decision-making as far as possible.

Working closely together, our specialists in employment and employment dispute resolution deliver comprehensive advice on the options open to you as an employer. You can rely on us to provide practical support through redundancy procedures, contractual variations, and representation at Employment Tribunals and all the way to court if that’s what it takes to get the best result for your business.

Employee Consultation

By law, employers must inform and consult with employees about certain matters. These matters will vary depending on the size of the organisation. Generally, the obligation is to:

- Provide enough information that the employee group can fully understand the matters being consulted

- Allow those consulted to express their views

- Genuinely consider those views before making a final decision.

Consultation may be directly with employees or indirectly through trade unions, staff councils or employee representatives.

What do employers need to consult about?

A (non-exhaustive) list of some of the most common reasons are below:

- Restructuring and redundancy – consultation with individual employees is fundamental to the fairness of the redundancy exercise. Where it’s intended to make 20 or more employees redundant within a 90-day period, collective consultation with unions is also required.

- Changes to contractual terms – such as fire and hire where employees are dismissed and offered re-engagement on new contracts

- Health and Safety – for example, the findings of a risk assessment.

- Transfers under TUPE – employees must be consulted on who will be affected by the transfer and measures taken in connection with it

- Pension changes to an employee pension scheme

How can Collyer Bristow help with employee consultation?

Consultation rules are complex and will vary from organisation to organisation and situation to situation. There is no single arrangement which will suit all businesses. Some of the key areas we can help with are:

- Planning the employee consultation procedure that will best suit your business

- Gathering any prescribed information to be provided

- Drafting letters and holding town hall type meetings

- Ensuring confidentiality and data protection compliance is observed

- Establishing works councils

- Defending complaints made by employees

We’ve worked with many organisations operating in different industries, including public organisations. We take the time to get to know your business so we can advise you on the best way forward to protect your interests, and preserve relationships with your employees.

Diversity & Discrimination

The Equality Act 2010 sets out nine characteristics, including sex, age and disability, that protect people from being discriminated against at work. Your organisation could face a costly Employment Tribunal claim, as well as reputation damage if your processes and workplace diversity initiatives (or lack of them) discriminate against certain employees.

What are discrimination claims?

Equality legislation applies from the very first interaction someone has with your organisation and applies to job applicants, candidates, employees, former employees, workers, agency workers and contractors. When someone makes a discrimination claim, they need to show evidence that they have been treated unfairly because of a protected characteristic.

How can we help discrimination claims and workplace diversity initiatives?

Our diversity and discrimination lawyers understand the sensitivity of these matters and the importance of resolving them quickly. We can help you tackle equality, diversity and discrimination issues with confidence.

Services include:

- Advising you on your obligations under the Equality Act and other legislation

- Analysing potential risks of discrimination at work

- Creating legally compliant employment contracts, policies and staff handbooks

- Helping you follow the correct procedures from recruitment to dismissal so that you can prove fair and equal treatment

- Drafting fair and consistent workplace diversity initiatives

- Negotiation and mediation to resolve disputes

- Representing you at an Employment Tribunal if a claim is made against you

Discrimination complaints could include:

- Differences in pay and benefits under the equal pay legislation

- Inappropriate behaviour, such as harassment or bullying based on a protected characteristic

- Discriminatory job advertisements, such as requiring a maximum number of years’ experience which would discriminate indirectly against older candidates

- Conscious or unconscious bias in interviews or promotions decisions

- Unfair rules, such as when a pregnant employee is not allowed to adjust the work tasks she is struggling with due to her pregnancy.

Can lack of diversity be a cause of discrimination?

Many companies are creating workplace diversity initiatives on the basis that diversity is not only good for business performance but also an important element of a company’s duty to prevent discrimination in the workplace. Research suggests that a lack of diversity in the workplace can promote discriminatory behaviour.

Ideally, these initiatives should be constructed with the help of a legal professional. Even the most well-intentioned workplace diversity initiative might result in a tribunal claim if it discriminates against a protected group. Employers must take extra care with positive action initiatives, for example, as they may result in people being temporarily treated differently in order to achieve an equal outcome, such as providing extra training to underrepresented groups.

Flexible working

Although flexible and agile working have been buzzwords in employment law for a few years now, the pandemic has forced it onto the agenda of all organisations, whatever their size, structure, sector or location.

Governance Issues

Certain employers have an obligation to engage with employees and deliver more reporting about the workforce. Most of the rules apply to listed companies, but there are also requirements for many unlisted companies.

The rules are introduced through different sources, including the latest UK Corporate Governance Code. However, the general legislative push is towards giving employees a louder voice in the boardroom.

What does engagement mean under UK governance laws?

Engagement means different things depending on the size and type of organisation. For example, companies may need to step up and provide:

- A director appointed from the workforce

- A workforce advisory panel

- A designated non-executive director to represent the interests of the workforce

- A means for employees to raise concerns in confidence

- Better reporting on various aspects of employee engagement and employees’ involvement in the company’s affairs

The various corporate governance codes also impose broad obligations on a company to justify executive pay, including by reference to pay ratios with the workforce, and explaining how executive pay aligns with wider company pay policy. These obligations may be extended in the future to include more formalised reporting on gender or ethnicity pay gaps.

How can we help with governance issues?

Governance rules usually apply on a ‘comply or explain’ basis, so every affected company needs to understand what their engagement and reporting obligations are. Our specialist governance lawyers can provide:

- Detailed guidance on your governance obligations

- Strategies for complying with those obligations

- Employee information and consultation

- Help with establishing staff councils

- Defence of your position to both employees and the regulators

- Help with avoiding legal missteps and penalties

We offer practical, realistic advice that goes beyond the letter of the law to protect your commercial interests. Clients come to us because we recognise the importance of negotiating carefully with employees, without damaging your workplace relationships. So whether you just need advice on your obligations, or representation in a complex governance dispute, we’re ready to support you.

NED Contracts

Finding the right person to become a non-executive director of the company can be challenging and time-consuming for the board. Not only does the NED need to have appropriate experience, but they need to be fully on board with the role and duties you wish them to fulfill. They also need to be happy with the remuneration package that’s on offer, especially if the package includes company shares as this has tax considerations for both the NED and the company.

When writing an NED contract, it’s important to have expert solicitors by your side. We’ve helped companies of all sizes put the right contracts in place, making sure that everyone is clear on the

obligations that the NED will be under in their director capacity, and their reward.

What is a non-executive director?

There is no statutory definition of an NED, but they typically are required to devote part of their time to a company as an independent adviser. Businesses recruit NEDs to achieve growth in the company, plan for exit, or bring additional expertise to the board.

As directors, NEDs are subject to the usual rules of the boardroom including the statutory directors’ duties set out in the Companies Act 2006. Non-executive directors appointed to listed companies are also subject to the UK Corporate Governance Code.

What NED contract services do we offer?

We can advise on:

- The terms of a NED contract

- Remuneration and equity aspects, including taxation

- Duties and liabilities

- Conflict and competitor issues

- Issues around switching from executive to non-executive status

- Director disputes

NED contracts can involve many different areas of law – from employment to commercial, finance, competition, litigation, and more. As a full-service law firm, we’re ready to cover all these bases so you don’t have to shop around to get the bespoke advice you need.

LTIPS and Bonus Schemes

Long term incentive plans – LTIPS – provide a way for companies to reward their staff with shares or cash at a future date as long as certain conditions are met. Listed companies must follow the rules of the UK Corporate Governance Code and the Listing Authority when designing these arrangements. Other restrictions may apply depending on the type of bonus scheme involved.

What are long-term incentive plans?

LTIPs and bonus schemes give someone a right to acquire shares at some future date at a fixed price. They are usually offered to senior executives as a reward for driving company performance to a specified level, such as a percentage uplift in economic profit or growth in share value.

LTIPS come in all shapes and sizes. Most are structured as a nil-cost option where the participant can call for the transfer of shares at a certain point for free. Since there is no income tax trigger until the option is exercised, the parties will usually wish to negotiate a flexible arrangement so the participant has the flexibility to exercise the share option at a tax-favourable time.

How can we help with LTIPS?

LTIPs are complex arrangements requiring expertise in the areas of contract law, employment and taxation. Our teams work together to:

- Design effective LTIPs arrangements

- Determine which participants should benefit from the scheme

- Negotiate performance goals and retention periods

- Design clawback arrangements if an employee performs poorly or, for example, it is later discovered that profits have been misstated

- Minimise the risk of disputes

- Protect the company’s tax position

We’ve supported many businesses operating in different industries with their LTIPs and bonus schemes. We take the time to get to know your business so we can advise you on the best arrangements that suit you and the scheme’s participants while delivering on core goals such as company growth.

Dismissals

Employees with more than two years’ service have protection against unfair dismissal and can file a complaint with the Employment Tribunal if they are dismissed for potentially illegitimate reasons.

Unfair dismissal compensation can be up to a year’s gross pay, so it’s essential for employers to get it right.

Settlement Agreements

Settlement agreements used to be called compromise agreements because that’s exactly what they are – a legally binding act of compromise between the employer and employee. Usually, they provide for a severance payment by the employer in exchange for the employee agreeing to not pursue a claim (e.g. for unfair dismissal) in an Employment Tribunal or court.

Why do employers use settlement agreements?

Signing a settlement agreement is often the best and quickest way to terminate an employment contract on terms favourable to the company. It achieves a clean break with no recourse for the employee to take you to a tribunal for more money. Situations, where you may wish to use a settlement agreement, include:

- You don’t want a full redundancy consultation or performance review before terminating

- You want to circumvent a claim for unfair dismissal

- The employee has raised a grievance that you’d like to resolve confidentiality

How do you negotiate a settlement agreement?

A settlement agreement will usually contain the following provisions:

- Breakdown of payments

- Notice periods or payments in lieu

- Provisions regarding pension rights, health insurance and other benefits

- Tax indemnities from the employee so you’re not making additional tax payments if HMRC challenges the settlement

- The affirmation of any restrictive covenants

- Confidentiality clauses

- Clauses to protect your reputation. e.g. preventing the employee from making derogatory statements against you

Our settlement agreements solicitors can help you negotiate the terms of an agreement, write an agreement, and monitor existing agreements to ensure the terms are still being met for the benefit of your business.

Employment Contracts

Most employers would rather not spend time and energy drafting employment contracts. That’s fine, as long as the Pro-forma contracts you use are clear, well-drafted, and appropriate for both the job role and your business.

What are the common problems with employment contracts?

Most business owners are aware that staff should have something in writing but it’s still surprising how many employers are using out-of-date contracts that are not in line with current legislation. The reality is that both employment and independent contractor law changes on a regular basis, and it’s vital that your contracts keep up.

Besides missing or out-of-date contracts, some of the common problems we see include:

- Template contracts that are not highly relevant to the needs of the business

- Lack of clarity on key terms

- Too wordy contracts that actually reduce the likelihood of the meaning being clear

- Inconsistency between contracts, which could give rise to unfairness or discrimination claims

- Missing protections such as confidentiality and restrictive covenants, meaning senior staff could take valuable information and contacts with them when they leave

How can Collyer Bristow help with your employment contracts?

We offer an end-to-end service for employers, from negotiating contracts to litigating them should a dispute ever end up before an Employment Tribunal or the court. Specific services include:

- Reviewing and updating your existing employment contracts

- Drafting bespoke contracts for staff and senior executives

- Drafting contracts for independent contracts, gig workers and other special relationships

- Dealing with employees who breach the terms of their employment contract

- Protections against IR35

- Defending claims for breach of contract

Our employment solicitors advise all types of employers nationwide. We can draft tight employment contracts that start your relationship off on the right foot while preventing problems from arising in the future.

Confidentiality Agreements

While the basics of a confidentiality agreement are usually uncontroversial, for employers, there’s a delicate balance to be struck in order to protect the company’s reputation without overstepping the mark.

When should an employer use a confidentiality agreement?

Not every employee will need to sign a confidentiality agreement, nor is it suitable for every type of organisation. In fact, a too-liberal use of confidentiality agreements could raise moral or ethical issues or lead to legal hot water. For example, confidentiality agreements cannot prevent individuals from blowing the whistle even if, on the face of it, that’s what the confidentiality agreement says.

However, when the employer legitimately needs a lot of protection for intellectual property, customer identities or other sensitive information, then confidentiality is a must.

Confidentiality agreements are also invaluable when an employer and employee make a settlement agreement to resolve a workplace dispute. In this instance, confidentiality clauses can both protect the compensation sum and other details of the agreement and also hide the fact that an agreement has been made.

How can we help with confidentiality agreements?

While the basics of a confidentiality agreement are usually uncontroversial, for employers, there’s a delicate balance to be struck in order to protect the company’s reputation without overstepping the mark. We can help you:

- Determine whether a confidentiality agreement is needed

- Define what is deemed to be confidential

- Draft tailored confidentiality agreements to protect the company’s position

- Seek injunctions to prevent a breach of a confidentiality agreement

- Draft and claim clawbacks of settlement sums if confidentiality is broken

- Enforce a confidentiality agreement through litigation or other means

Our employment disputes team specialise in developing the best settlement and confidentiality terms possible for our clients. We act for employers of all sizes, including in complex transactions that include multiple settlements.

Policies and Staff Handbooks

Your employment policies and procedures operate alongside your employment contracts to lay down the rules within which you expect your staff to work. Staff handbooks generally cover areas that do not naturally fit into contracts, such as the company’s position on parental leave, disciplinary and grievance policies, harassment, discrimination, sickness and flexible working.

Are employment policies and staff handbooks a legal requirement?

While employment policies and staff handbooks are not a legal requirement, it is certainly best practice to put them in place. These documents set out the rights and responsibilities of staff and ensure that:

- Staff know what is expected of them

- Rights and obligations keep up to date with employment law changes

- The same employment policies apply to all persons, helping to prevent expensive discrimination claims

- Dismissal, disciplinary and grievance procedures are clearly communicated, reducing unfair dismissal claims

Having clear policies on roles, responsibility, training, supervision and quality assurance will also assist with achieving any quality accreditation you apply for such as ISO 9001.

Do you need a lawyer to draft a staff handbook?

Employment policies can be contractual or non-contractual. If a staff handbook is expressed to be contractual, it will be treated as though all of its contents were written into your company’s employment contracts. If the employee or the employer fails to adhere to a policy, they may be liable for breach of contract. An employer who breaches their own policies leaves the door wide open to constructive dismissal claims.

A non-contractual staff handbook offers greater flexibility since they are not automatically included in an employment contract. However, that does not mean that, in the event of an Employment Tribunal claim, your handbook won’t come under scrutiny. If in doubt, it is always better to seek help from a legal professional.

We can help:

- Advise on the most appropriate policies for your business

- Prepare bespoke and jargon-free staff handbooks

- Update existing staff handbooks to make sure they’re legally compliant

- Help your business to deal with any claims arising from your employment policies and procedures

We’ve helped businesses of all sizes create staff handbooks. We’ll work with you to create employment policies and procedures that suit your organisation and serve as the go-to document for managers and staff.

Employee Relations

A positive climate of employee relations can be a significant factor in achieving long-term commercial success. Sadly, relationships with employees and trade unions can easily become strained, especially if your business is planning redundancies, pay freezes or changes to working conditions.

What is employee relations?

Employee relations is a broad term describing the relationship between employers and employees. We use it to describe both individual and collective relationships in the workplace. This recognises the fact that, while trade union influence is still an everyday reality in some industries, individual employee engagement is now a fundamental part of the employment relationship.

There are a wide range of legal provisions that apply when managing employee relations. For individuals, employment contracts, staff handbooks and employment policies govern the relationship, and these are subject to important legislation in the areas of quality, discrimination, dismissal and discipline handling.

For collective relationships, there are rules on collective bargaining, consultation and industrial action. Employers may work with recognised trade unions to negotiate pay and conditions, or to consult over structural changes such as TUPE transfers or redundancy.

What employee relations issues might employers face?

Since almost everything you do affects your employees, the scope of employee relations disputes is very wide. Common issues our solicitors can help you with include:

- Developing an effective employee relations strategy

- Communicating effectively with trade unions, employees representatives and staff

- Trade union recognition

- Collective bargaining

- Defending union-backed industrial action

- Employee consultations in TUPE and redundancy situations

- Establishing works councils

- Representing your business in litigation and Employment Tribunal claims

Our team advises high-profile clients on employee relations and collective bargaining issues. With our in-depth knowledge of labour law, we can help improve the quality of your working relations with employee representatives and unions – so they don’t bring your organisation to a halt.

Trade Union Recognition

What is trade union recognition?

When an employer recognises a trade union, it means that the employer will undertake collective bargaining with union representatives on certain issues, for example, pay levels, the allocation of work duties, and hiring, firing or suspending employees. This is known as collective bargaining.

Most employers will recognise a trade union voluntarily. If an employer refuses, the union is legally entitled to apply to the Central Arbitration Committee (CAC) for an order granting recognition if certain conditions are satisfied.

What does trade union recognition mean for my organisation?

Recognised unions enjoy a legal right to be provided with certain information by the employer so they can fully engage in collective bargaining. ACAS has produced a Code of Practice on what information an employer should provide. If the union is unhappy with the level of information-sharing, it may apply to the CAC for a disclosure order.

A recognition agreement with a trade union also means that the employer must consult with the union’s representatives on certain matters. These include:

- TUPE transfers

- Multiple redundancies

- Pension scheme changes

- Certain health and safety matters

How does a union get trade union recognition?

There are two ways in which a trade union may seek recognition:

- By voluntary agreement from the employer; or

- By the statutory procedure laid out in the Employment Relations Act 1999.

The statutory procedure involves an application to CAC, which decides whether to grant the trade union recognition or not. CAC uses various tests when making its decision including levels of membership within your organisation and ballot results.

The rules are complex and strict timetables govern these applications. However, as long as the rules are followed, the final decision on whether to recognise a trade union will rest with the CAC and the matter is, for the most part, taken out of an employer’s hands.

As such, it is often better for employers to reach agreement voluntarily rather than having the CAC impose an outcome against its wishes. Voluntary trade union recognition gives an employer more control over important decisions such as which group of employees should constitute a bargaining unit and what decisions they can consult in.

How can Collyer Bristow help with trade union recognition?

Work with us, and we will make sure that your trade union recognition agreement is well balanced and does not unduly restrict your commercial operations.

As well as voluntary trade union recognition agreements, we can support your CAC applications, threats of industrial action and terminating trade union recognition. Talk to us about your needs.

Gig Economy Issues

Asking freelancers to work for you on a self-employed basis makes it possible to improve flexibility while dramatically cutting operating costs. But it’s important that the label you give your ‘gig workers’ accurately reflects their legal status. Get it wrong, and your gig workers could become entitled to pay and benefits that you did not budget for.

How do you determine employment status in the gig economy?

The law provides for a spectrum of workplace relationships. At one end of the spectrum are employees, who have a wide range of employment protections. At the other end are self-employed independent contractors who have no employment protections at all.

‘Worker’ status is a halfway house between employee and self-employed status. Workers have fewer employment protections than employees, but they are entitled to the minimum wage, protection from discrimination, and whistleblower protections, among other things.

What do I need to think about when hiring gig economy employers?

Courts around the world have shown that they are not fooled by self-employment contracts, and instead are willing to give gig workers the rights they are entitled to. This has serious ramifications for employers who wish to engage individuals on a self-employed basis. Businesses need to think carefully about the structure of their operating models, because it’s what gig workers do day-to-day that determines the nature of the relationship, not the label or the job description set out in their contract.

At Collyer Bristow, we can help with:

- Determining the status of gig workers

- A review of your contracts to make sure that self-employed status stands up to scrutiny

- Advice on workers rights

- Tax issues, including income tax, NIC and VAT liability

- IR35 issues

- Representing at Employment Tribunals and in court

- Defending your position with HMRC

We understand that the gig economy issues you face are unique to your organisation and how you operate your business. Our employment disputes team has the expertise to give you practical advice and strategies to help you avoid any major shocks and continue a positive relationship with all your workers.

Industrial Action

What is industrial action?

There is no right to strike in the UK. However, trade unions and their members do benefit from a wide range of statutory protections, including those set out in the Trade Union Act 2016. This Act contains a challenging and complex set of legal hurdles that unions must overcome whenever they wish to put pressure on their employers through strikes or other action.

What are an employer’s rights when it comes to industrial action?

Industrial action occurs when all or some of the members of a trade union either refuse to work or refuse to work in the way you want. The most obvious example is a strike, but it can also include other action such as picketing, overtime bans, and work to rule.

In theory, the 2016 Act should make it more difficult for unions to call strikes. There are strict legal rules for any strike to be lawful, including the support of members as determined by a lawful ballot with independent scrutiny, in which at least half the balloted workers have voted.

You do not have to pay employees who are on strike. However, it is automatically unfair to dismiss someone who’s taken part in any lawful industrial action within 12 weeks of the dismissal.

Employees who take part in unofficial industrial action – so-called wildcat strikes – are not protected from dismissal.

Do I need a lawyer to resolve the threat of industrial action?

Whether serious or not, the threat of industrial action can result in a highly charged workplace situation. If your organisation is facing these risks, there is no doubt that you will need specialist advice to stop the industrial unrest from escalating. Strikes and slowdowns can be extremely damaging to productivity, service delivery and your brand’s reputation, as well as causing significant financial damage in many cases.

Collyer Bristow’s specialist industrial action team can help in a number of ways, including:

- Determining whether industrial action has been lawfully organised

- Negotiating with trade unions

- Injunctions to stop the action

- If necessary, litigating the industrial action

- Determining whether employees are acting in breach of contract and whether an employer is entitled to withhold pay

- Formulating strategies to avoid future disputes strategy

We know the Trade Union Act 2016 inside out. Our expert team can give you clear and robust advice to help you negotiate through the complexities of industrial action, and achieve successful resolution with working relationships still intact.

Works Councils / Employee Forums

What is a works council?

All UK employers with 50 or more staff are required to establish a formal works council (also called a staff council or employee forum) if requested to do so. You can also set up a works council voluntarily, without a request from employees.

Once a request is made, the company and its employees have six months to come up with a formal agreement on how the staff council is going to run and what its remit will be.

Do I have to establish a works council?

There is no requirement for an employer to establish a works council unless a sufficient number of employees request it in writing. The ‘sufficient number’ is currently 2% of the workforce, although that number is adjusted for very small or very large organisations.

Before April 2020, the necessary level of support had been 10% of employees. This significant reduction indicates the government’ strong support for the establishment of works councils, as far fewer employees will now be required to make up a valid request.

What are an employer’s legal obligations towards a staff council?

Once a valid request is received, the parties are free to negotiate the type of council or forum they wish to create. This might be a staff council, an employee engagement forum, or a forum tied into trade union recognition agreements if specific conditions are met.

Once negotiated, the agreement is then formalised under an Information and Consultation (I&C) agreement. The employer must now inform and consult with the staff council on significant matters and decisions affecting the organisation. These commonly include:

- Major changes to working conditions

- Job prospects

- The economic state of the business

- Training

- Health and safety

- Staffing levels

If the parties cannot agree on the scope and mechanisms for the staff council, then a template set of rules will automatically apply. Since these rules do not support the need of employers to be able to make swift commercial decisions, without having to consult on every small matter, it is far better to negotiate openly with employees and secure the best terms for your business.

How can Collyer Bristow support with employee forums and staff councils?

Establishing a staff council does not mean you have to change any business decisions you plan to take. But you do have to share information and openly listen to the council’s feedback and concerns. As a minimum, this will slow and compromise certain aspects of decision making.

The employment team at Collyer Bristow can help you meet these challenges head-on. Talk to our experienced lawyers about establishing an arrangement you can live with, and that adds value to your decisions making, rather than relying on a template agreement that potentially will compromise your ability to run your business.

Employment Tribunal Proceedings

Job candidates and employees who feel that their employer or potential employer has treated them unlawfully have the right to make a claim to an Employment Tribunal. The Tribunal can make decisions on a wide range of employment issues, including redundancy, unfair dismissal and discrimination.

What are employment tribunals?

Employment Tribunals are specialist forums designed to hear claims relating to many types of employment disputes. Whether an employee can make a claim depends on what the issue is about and whether they meet certain conditions such as time limits.

Going to a tribunal should be the final step in the dispute resolution process after all other methods have broken down. Once the employee has exhausted the company’s internal processes, they are encouraged to attempt reconciliation through the Advisory, Conciliation and Arbitration Service (ACAS) before going the legal route. Making a claim to an Employment Tribunal is the last resort.

How can we help you defend a claim at an employment tribunal?

It is easy to panic in the face of litigation but our specialist employment disputes team have defended many claims at early conciliation and at the Employment Tribunal. We can help:

- Weigh up the strength of the case

- Negotiate settlement agreements and severance packages, where this is in the company’s best interests

- Strike out weak and frivolous claims

- Prepare a winning defence

- Collate evidence on mitigation, to minimise the value of any compensatory award made against you

- Appeal Tribunal decisions on points of law

Our specialist Employment team has successfully defended many claims so you can trust that we have the expertise needed to protect your best interests. Our approach is commercial and pragmatic – if you want to draw a line under the dispute by offering a settlement agreement, we will negotiate the best possible deal for you. If you want to defeat the claim, we will assist you in formulating a solid defence whilst clearly advising you on the potential risks.

IR35 Guidance

What are the IR35 rules?

IR35 off-payroll rules apply if a contractor operates through their own personal service company (PSC) or other intermediaries. HMRC has not defined a PSC, but it usually means a limited company where the sole or majority director and/or shareholder provides the services of the company.

Sometimes, the hiring employer will have a contract with a PSC but in reality the relationship looks more like that of an employer and employee, since it is the same contractor providing the services each day. Under IR35 law, this person is considered to be a ‘deemed employee.’

What is the impact of IR35 law on employers?

The government tool ‘check employment status for tax’ can help you decide if the contractor should be classified as employed or self-employed for tax purposes. If IR35 applies, the employer must collect tax and National Insurance Contribution from sums paid to the PSC and pay them to HMRC – essentially as PAYE taxation.

The responsibility for determining IR35 status rests with the end client, as does the resulting tax liability. As a result, many businesses automatically are classifying PSC workers as inside IR35, even though this may not deliver the best results for their business.

If a business fails to make an IR35 determination or gets it wrong, the liability for income tax and NICs will sit with the employer until the determination is completed. There’s also the risk of HMRC investigation, penalties and legal proceedings for non-compliance.

What are Collyer Bristow’s IR35 legal services?

At Collyer Bristow, we can help you:

- Make watertight IR35 status determinations

- Review your contracts for IR35 exposure

- Defend status determination with the contractor and HMRC

- Draft bespoke contracts and contractor working practices with the proper protections built-in

- Renegotiate contracts that were prepared before the IR35 rules changed in April 2021

- Avoid significant penalties from HMRC

- Manage HMRC investigations

- Defend and appeal claims from both Employment Tribunals and Tax Tribunals if you get it wrong

Comprising employment, tax and commercial disputes lawyers, our specialists provide comprehensive, commercially minded advice whether you hire 1 contractor or 100. If you have an issue regarding IR35 law, we can offer fast, reliable guidance and support that’s second to none.

Employment lawyers Publications

Employment and Immigration Expertise

An overview of our Employment and Immigration services.

Employment lawyers

An overview of our Employment services. Our Employment Lawyers work closely with many types of clients across a wide range of sectors providing advice on a variety of issues, whether they are HR-related, strategic, complex or contentious.

Employment and Immigration Expertise for Financial Services

An overview of our Employment and Immigration services within the financial services sector.

Advice for senior executives

Conflicts at work can be distressing and daunting for a variety of reasons and trying to deal with them on your own is difficult. We can help to clarify the situation for you by providing clear, practical and confidential guidance.

Employing domestic staff in the UK

This guide sets out the key legal considerations when hiring domestic staff in the UK and seeks to help you build an employment relationship that is both effective and compliant.

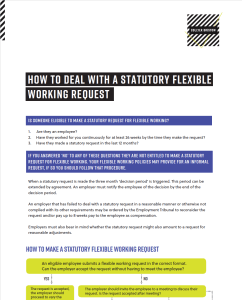

How to deal with a statutory flexible working request

Collyer Bristow’s Employment team has prepared a useful step-by-step flowchart for employers, guiding them through the complex process of dealing with a statutory flexible working request from an employee.

IR35: An overview of the changes

An overview of the IR35 tax rules now extending to the private sector. For affected contractors and businesses using their services, there are now significant tax and practical consequences.

"LEGAL ADVICE THAT IS FAST, METICULOUS AND TAILORED TO YOUR BUSINESS”

Addison Lee

Employment lawyers insights

Shorter Reads

Sexual Harassment & the risk of relying on workplace ‘banter’ to defend a claimSexual Harassment & the risk of relying on workplace ‘banter’ to defend a claim

Read more

Shorter Reads

Labour wins UK general election: What changes are coming for employers?Labour wins UK general election: What changes are coming for employers?

Read more

Shorter Reads

Fired over Mouse Jiggling: the employment law risks of TikTok ‘work hacks’Fired over Mouse Jiggling: the employment law risks of TikTok ‘work hacks’

Read more

Longer Reads

Supreme Court rules UK trade union law is ‘incompatible’ with human rightsSupreme Court rules UK trade union law is ‘incompatible’ with human rights

Read more

Longer Reads

Spring 2024 Employment law updateSpring 2024 Employment law update

Read more

Shorter Reads

What are the new changes to Statutory Paternity Leave?What are the new changes to Statutory Paternity Leave?

Read more

Longer Reads

What impact would a right to disconnect have?What impact would a right to disconnect have?

Read more

Shorter Reads

The legal implications of software surveillanceThe legal implications of software surveillance

Read more

Longer Reads

Avoiding class discrimination in the workplaceAvoiding class discrimination in the workplace

Read more

Shorter Reads

Autumn Statement 2023: key announcements for the employment sectorAutumn Statement 2023: key announcements for the employment sector

Read more

Longer Reads

Lack of clarity about decision-maker in pregnancy-related dismissalLack of clarity about decision-maker in pregnancy-related dismissal

Read more

Longer Reads

Government lays down draft regulations amending Working Time and TUPEGovernment lays down draft regulations amending Working Time and TUPE

Read more

You might also like

Need some more information? Make an enquiry below

Employment lawyers key contacts

- Tania

GoodmanPartner - Head of Employment

Talk to Tania about Employment law for employees and Employment law for employers

Employment lawyers

Helping you navigate and adapt to the changing landscape

Your workforce is the essence of your business and needs to be effective. The challenge can come from the fact that employment law is dynamic and rapidly evolving with a constant stream of new rules and regulations. As the employer, you want to be in a good place for recruiting and retaining employees as well as dismissing them fairly should the need arise.

The Team

Our lawyers have the expertise and experience to provide you with creative, personalised solutions in a clear and understandable way.

Our Publications

Discover a wealth of invaluable guidance in the form of guides and brochures written by our expert lawyers.

Hybrid working - knowledge hub

Although flexible and agile working have been buzzwords in employment law for a few years now, the pandemic has forced it onto the agenda of all organisations, whatever their size, structure, sector or location.

Helping employers manage statutory flexible working requests

Pragmatic advice to move your business forward

Our Employment Lawyers have the expertise and experience to help you navigate and adapt to the changing landscape and provide innovative solutions. We work closely with many types of clients across a wide range of sectors providing advice on a variety of issues, whether they are HR-related, strategic, complex or contentious.

We get to know your business, working practices, culture and commercial objectives. This enables us to provide tailored and pragmatic advice to help your organisation move forward and minimise HR headaches and disruption. Where possible we promote the early resolution of employment disputes but, when this cannot be achieved, we guide you through the litigation process with a commitment to delivering the best possible result for your business.

Our Employment team provides both a highly proactive and pragmatic client service and is experienced in all aspects of employment law.

Our immigration team offers a personal and tailored service to businesses and private clients. With a thorough knowledge of the UK immigration rules and by gaining a full understanding of your unique circumstances and priorities, we can determine the route which best fits your requirements from across the UK visa tiers. We then guide you practically and pragmatically through the immigration process, also advising on any relevant tax planning implications.

Tania GoodmanPartner - Head of Employment

View Tania Goodman's profileAbbie ArmstrongTrainee Solicitor

View Abbie Armstrong's profileAndrew GrangerPartner

View Andrew Granger's profileSinead KellySenior Associate

View Sinead Kelly's profileTom HerbertAssociate

View Tom Herbert's profileSelect a specific Employment lawyers service

- Recruitment Law

- TUPE

- Restructuring & Redundancy

- Employee Consultation

- Diversity & Discrimination

- Flexible working

- Governance Issues

- NED Contracts

- LTIPS and Bonus Schemes

- Dismissals

- Settlement Agreements

- Employment Contracts

- Confidentiality Agreements

- Policies and Staff Handbooks

- Employee Relations

- Trade Union Recognition

- Gig Economy Issues

- Industrial Action

- Works Councils / Employee Forums

- Employment Tribunal Proceedings

- IR35 Guidance

Recruitment Law

Employees are a valuable asset for any business and your relationship with them starts from the very first job advertisement. Creating an effective hiring and selection policy, in full accordance with recruitment law, makes it easier to recruit a well-structured team and avoid making harmful or potentially discriminatory decisions.

What legal issues do employers face in recruitment?

Our specialist recruitment law solicitors can help protect your rights from the very first interaction. Common issues include:

- Lengthy and complex recruitment processes that are rife with discrimination risks

- Understanding which ‘positive action’ steps can be lawfully taken to encourage candidates from under-represented groups

- Overcoming bias during the screening and interview process

- The legalities of choosing a candidate who has a protected characteristic over one who does not

- Diversity and discrimination in recruitment law

- Right to work laws if you are recruiting candidates from overseas

- Recruitment outsourcing and agency disputes

- Recruiting gig economy workers and contractors within or outside IR35

How can our recruitment law team help?

Our recruitment law team has a real understanding of the commercial needs of your business and we deliver our advice accordingly. We can advise on one-time issues or act as an extension of your HR team, offering robust recruitment support on legislation to ensure your business is compliant of your obligations during each stage of the recruitment process.

Should a dispute arise in regards to recruitment, we can give you the best legal representation, taking claims to the Employment Tribunal and to court where appropriate. We have a reputation for offering fast, creative solutions to recruitment disputes. It’s our job to minimise disruption to your business so that you can concentrate on recruiting the best candidate for your job.

TUPE

The Transfer of Undertakings (Protection of Employment) Regulations 2006 protects employee rights if a business changes ownership and during other types of restructuring. They give several duties to both the old employer and the new one. Failure to perform these duties could lead to an expensive Employment Tribunal claim. We help employers avoid the risks associated with a business transfer. Our specialist TUPE team can help you tick all the boxes so the transfer goes ahead with the best possible protection for your business.

What issues might employers face under TUPE?

The TUPE Regulations are a complex beast and there is a lot to consider if you are to avoid a costly legal dispute. The main thrust of the legislation is to shift employees – and all liabilities associated with them – to the new employer. To protect your business from claims, you need to understand when TUPE applies, what you have to do to comply with the Regulations, what steps you can take to protect your business from claims, and the penalties that apply if things go wrong.

Tricky issues that can often trip employers up include:

- Disagreements as to which employees should transfer under TUPE

- The correction of liabilities such as national minimum wage underpayments

- Harmonising terms in employment contracts of staff after a TUPE transfer, especially where some employees have generous share or profit-sharing schemes

- Permitted changes to employment contracts for ‘economical, technical or organisational’ (ETO) reasons

- Trade union consultations

- Dismissals and redundancies

- Failure to comply with due diligence disclosures

- The enforcement of restrictive covenants after a TUPE transfer

How can we help?

Knowing when and how TUPE applies to your situation is the first step to being compliant. We can help you negotiate the TUPE clauses in your employment contract, manage the consultation process, draft letters to employees, support you through redundancies and defend claims made to Employment Tribunals or through the courts.

Our team consists of transactional and contentious disputes lawyers. Together, our employment lawyers can ensure that you not only avoid and quickly resolve any disputes under TUPE, but you also have the ongoing support you need after the transfer as you streamline operations and focus on growth.

Restructuring & Redundancy

It is a tough decision to relocate or demote employees or make them redundant. But if you are closing down a branch, consolidating operations, or moving to a new site, then a certain number of job adjustments may be inevitable. Our Employment Lawyers can protect your business from any claim arising from a change in organisational structure, including post-restructuring grievance proceedings from employees who are unhappy in their new roles.

What is the redundancy process?

The role must be disappearing for there to be a true redundancy situation. Normally, that will be because:

- The business is closing

- A site or workplace is closing down or moving

- You no longer need as many workers to do a particular type of work, e.g because of new technology

The process itself includes a consultation with individual employees before making any final decisions. If you are planning to make 20 or more employees redundant within a 90-day period, you’ll also have to consult with a trade union or staff council/employee forum. Employers must act reasonably and be able to justify the selection of the pool of employees they will be using when choosing who to make redundant.

What is suitable alternative employment in redundancy?

Specifically, in a restructuring situation, employers will be looking to make efficient use of their employees by offering ‘suitable alternative employment’ to an employee whose job is no longer needed, but who you wish to retain after the reorganisation.

By law, the test for whether an alternative role is suitable is largely a subjective one. In other words, the employee can decline the offer and opt for redundancy if the new role would, for example, lead to longer travelling times, upset childcare commitments, require retraining, or impose extra costs on the employee.

When conflict arises, it’s usually because:

- The employee believes the offer of alternative employment was not suitable

- The employer believes the employee was unreasonable in refusing the alternative work

- An employer is trying to change an employee’s job role without their consent

- An employee feels like they were discriminated against or not given a fair chance at an interview for a new role

How can our redundancy lawyers help?

Whatever the nature of the restructuring and redundancy dispute, it is wise to try to prevent it from escalating to an Employment Tribunal. Many potential conflicts can be headed off at the pass through a proper consultation procedure where employees are involved in the decision-making as far as possible.

Working closely together, our specialists in employment and employment dispute resolution deliver comprehensive advice on the options open to you as an employer. You can rely on us to provide practical support through redundancy procedures, contractual variations, and representation at Employment Tribunals and all the way to court if that’s what it takes to get the best result for your business.

Employee Consultation

By law, employers must inform and consult with employees about certain matters. These matters will vary depending on the size of the organisation. Generally, the obligation is to:

- Provide enough information that the employee group can fully understand the matters being consulted

- Allow those consulted to express their views

- Genuinely consider those views before making a final decision.

Consultation may be directly with employees or indirectly through trade unions, staff councils or employee representatives.

What do employers need to consult about?

A (non-exhaustive) list of some of the most common reasons are below:

- Restructuring and redundancy – consultation with individual employees is fundamental to the fairness of the redundancy exercise. Where it’s intended to make 20 or more employees redundant within a 90-day period, collective consultation with unions is also required.

- Changes to contractual terms – such as fire and hire where employees are dismissed and offered re-engagement on new contracts

- Health and Safety – for example, the findings of a risk assessment.

- Transfers under TUPE – employees must be consulted on who will be affected by the transfer and measures taken in connection with it

- Pension changes to an employee pension scheme

How can Collyer Bristow help with employee consultation?

Consultation rules are complex and will vary from organisation to organisation and situation to situation. There is no single arrangement which will suit all businesses. Some of the key areas we can help with are:

- Planning the employee consultation procedure that will best suit your business

- Gathering any prescribed information to be provided

- Drafting letters and holding town hall type meetings

- Ensuring confidentiality and data protection compliance is observed

- Establishing works councils

- Defending complaints made by employees

We’ve worked with many organisations operating in different industries, including public organisations. We take the time to get to know your business so we can advise you on the best way forward to protect your interests, and preserve relationships with your employees.

Diversity & Discrimination

The Equality Act 2010 sets out nine characteristics, including sex, age and disability, that protect people from being discriminated against at work. Your organisation could face a costly Employment Tribunal claim, as well as reputation damage if your processes and workplace diversity initiatives (or lack of them) discriminate against certain employees.

What are discrimination claims?

Equality legislation applies from the very first interaction someone has with your organisation and applies to job applicants, candidates, employees, former employees, workers, agency workers and contractors. When someone makes a discrimination claim, they need to show evidence that they have been treated unfairly because of a protected characteristic.

How can we help discrimination claims and workplace diversity initiatives?

Our diversity and discrimination lawyers understand the sensitivity of these matters and the importance of resolving them quickly. We can help you tackle equality, diversity and discrimination issues with confidence.

Services include:

- Advising you on your obligations under the Equality Act and other legislation

- Analysing potential risks of discrimination at work

- Creating legally compliant employment contracts, policies and staff handbooks

- Helping you follow the correct procedures from recruitment to dismissal so that you can prove fair and equal treatment

- Drafting fair and consistent workplace diversity initiatives

- Negotiation and mediation to resolve disputes

- Representing you at an Employment Tribunal if a claim is made against you

Discrimination complaints could include:

- Differences in pay and benefits under the equal pay legislation

- Inappropriate behaviour, such as harassment or bullying based on a protected characteristic

- Discriminatory job advertisements, such as requiring a maximum number of years’ experience which would discriminate indirectly against older candidates

- Conscious or unconscious bias in interviews or promotions decisions

- Unfair rules, such as when a pregnant employee is not allowed to adjust the work tasks she is struggling with due to her pregnancy.

Can lack of diversity be a cause of discrimination?

Many companies are creating workplace diversity initiatives on the basis that diversity is not only good for business performance but also an important element of a company’s duty to prevent discrimination in the workplace. Research suggests that a lack of diversity in the workplace can promote discriminatory behaviour.

Ideally, these initiatives should be constructed with the help of a legal professional. Even the most well-intentioned workplace diversity initiative might result in a tribunal claim if it discriminates against a protected group. Employers must take extra care with positive action initiatives, for example, as they may result in people being temporarily treated differently in order to achieve an equal outcome, such as providing extra training to underrepresented groups.

Flexible working

Although flexible and agile working have been buzzwords in employment law for a few years now, the pandemic has forced it onto the agenda of all organisations, whatever their size, structure, sector or location.

Governance Issues

Certain employers have an obligation to engage with employees and deliver more reporting about the workforce. Most of the rules apply to listed companies, but there are also requirements for many unlisted companies.

The rules are introduced through different sources, including the latest UK Corporate Governance Code. However, the general legislative push is towards giving employees a louder voice in the boardroom.

What does engagement mean under UK governance laws?

Engagement means different things depending on the size and type of organisation. For example, companies may need to step up and provide:

- A director appointed from the workforce

- A workforce advisory panel

- A designated non-executive director to represent the interests of the workforce

- A means for employees to raise concerns in confidence

- Better reporting on various aspects of employee engagement and employees’ involvement in the company’s affairs

The various corporate governance codes also impose broad obligations on a company to justify executive pay, including by reference to pay ratios with the workforce, and explaining how executive pay aligns with wider company pay policy. These obligations may be extended in the future to include more formalised reporting on gender or ethnicity pay gaps.

How can we help with governance issues?

Governance rules usually apply on a ‘comply or explain’ basis, so every affected company needs to understand what their engagement and reporting obligations are. Our specialist governance lawyers can provide:

- Detailed guidance on your governance obligations

- Strategies for complying with those obligations

- Employee information and consultation

- Help with establishing staff councils

- Defence of your position to both employees and the regulators

- Help with avoiding legal missteps and penalties

We offer practical, realistic advice that goes beyond the letter of the law to protect your commercial interests. Clients come to us because we recognise the importance of negotiating carefully with employees, without damaging your workplace relationships. So whether you just need advice on your obligations, or representation in a complex governance dispute, we’re ready to support you.

NED Contracts

Finding the right person to become a non-executive director of the company can be challenging and time-consuming for the board. Not only does the NED need to have appropriate experience, but they need to be fully on board with the role and duties you wish them to fulfill. They also need to be happy with the remuneration package that’s on offer, especially if the package includes company shares as this has tax considerations for both the NED and the company.

When writing an NED contract, it’s important to have expert solicitors by your side. We’ve helped companies of all sizes put the right contracts in place, making sure that everyone is clear on the

obligations that the NED will be under in their director capacity, and their reward.

What is a non-executive director?

There is no statutory definition of an NED, but they typically are required to devote part of their time to a company as an independent adviser. Businesses recruit NEDs to achieve growth in the company, plan for exit, or bring additional expertise to the board.

As directors, NEDs are subject to the usual rules of the boardroom including the statutory directors’ duties set out in the Companies Act 2006. Non-executive directors appointed to listed companies are also subject to the UK Corporate Governance Code.

What NED contract services do we offer?

We can advise on:

- The terms of a NED contract

- Remuneration and equity aspects, including taxation

- Duties and liabilities

- Conflict and competitor issues

- Issues around switching from executive to non-executive status

- Director disputes

NED contracts can involve many different areas of law – from employment to commercial, finance, competition, litigation, and more. As a full-service law firm, we’re ready to cover all these bases so you don’t have to shop around to get the bespoke advice you need.

LTIPS and Bonus Schemes

Long term incentive plans – LTIPS – provide a way for companies to reward their staff with shares or cash at a future date as long as certain conditions are met. Listed companies must follow the rules of the UK Corporate Governance Code and the Listing Authority when designing these arrangements. Other restrictions may apply depending on the type of bonus scheme involved.

What are long-term incentive plans?

LTIPs and bonus schemes give someone a right to acquire shares at some future date at a fixed price. They are usually offered to senior executives as a reward for driving company performance to a specified level, such as a percentage uplift in economic profit or growth in share value.

LTIPS come in all shapes and sizes. Most are structured as a nil-cost option where the participant can call for the transfer of shares at a certain point for free. Since there is no income tax trigger until the option is exercised, the parties will usually wish to negotiate a flexible arrangement so the participant has the flexibility to exercise the share option at a tax-favourable time.

How can we help with LTIPS?

LTIPs are complex arrangements requiring expertise in the areas of contract law, employment and taxation. Our teams work together to:

- Design effective LTIPs arrangements

- Determine which participants should benefit from the scheme

- Negotiate performance goals and retention periods

- Design clawback arrangements if an employee performs poorly or, for example, it is later discovered that profits have been misstated

- Minimise the risk of disputes

- Protect the company’s tax position

We’ve supported many businesses operating in different industries with their LTIPs and bonus schemes. We take the time to get to know your business so we can advise you on the best arrangements that suit you and the scheme’s participants while delivering on core goals such as company growth.

Dismissals

Employees with more than two years’ service have protection against unfair dismissal and can file a complaint with the Employment Tribunal if they are dismissed for potentially illegitimate reasons.

Unfair dismissal compensation can be up to a year’s gross pay, so it’s essential for employers to get it right.

Settlement Agreements

Settlement agreements used to be called compromise agreements because that’s exactly what they are – a legally binding act of compromise between the employer and employee. Usually, they provide for a severance payment by the employer in exchange for the employee agreeing to not pursue a claim (e.g. for unfair dismissal) in an Employment Tribunal or court.

Why do employers use settlement agreements?

Signing a settlement agreement is often the best and quickest way to terminate an employment contract on terms favourable to the company. It achieves a clean break with no recourse for the employee to take you to a tribunal for more money. Situations, where you may wish to use a settlement agreement, include:

- You don’t want a full redundancy consultation or performance review before terminating

- You want to circumvent a claim for unfair dismissal

- The employee has raised a grievance that you’d like to resolve confidentiality

How do you negotiate a settlement agreement?

A settlement agreement will usually contain the following provisions:

- Breakdown of payments

- Notice periods or payments in lieu

- Provisions regarding pension rights, health insurance and other benefits

- Tax indemnities from the employee so you’re not making additional tax payments if HMRC challenges the settlement

- The affirmation of any restrictive covenants

- Confidentiality clauses

- Clauses to protect your reputation. e.g. preventing the employee from making derogatory statements against you

Our settlement agreements solicitors can help you negotiate the terms of an agreement, write an agreement, and monitor existing agreements to ensure the terms are still being met for the benefit of your business.

Employment Contracts

Most employers would rather not spend time and energy drafting employment contracts. That’s fine, as long as the Pro-forma contracts you use are clear, well-drafted, and appropriate for both the job role and your business.

What are the common problems with employment contracts?

Most business owners are aware that staff should have something in writing but it’s still surprising how many employers are using out-of-date contracts that are not in line with current legislation. The reality is that both employment and independent contractor law changes on a regular basis, and it’s vital that your contracts keep up.

Besides missing or out-of-date contracts, some of the common problems we see include:

- Template contracts that are not highly relevant to the needs of the business

- Lack of clarity on key terms

- Too wordy contracts that actually reduce the likelihood of the meaning being clear

- Inconsistency between contracts, which could give rise to unfairness or discrimination claims

- Missing protections such as confidentiality and restrictive covenants, meaning senior staff could take valuable information and contacts with them when they leave

How can Collyer Bristow help with your employment contracts?

We offer an end-to-end service for employers, from negotiating contracts to litigating them should a dispute ever end up before an Employment Tribunal or the court. Specific services include:

- Reviewing and updating your existing employment contracts

- Drafting bespoke contracts for staff and senior executives

- Drafting contracts for independent contracts, gig workers and other special relationships

- Dealing with employees who breach the terms of their employment contract

- Protections against IR35

- Defending claims for breach of contract