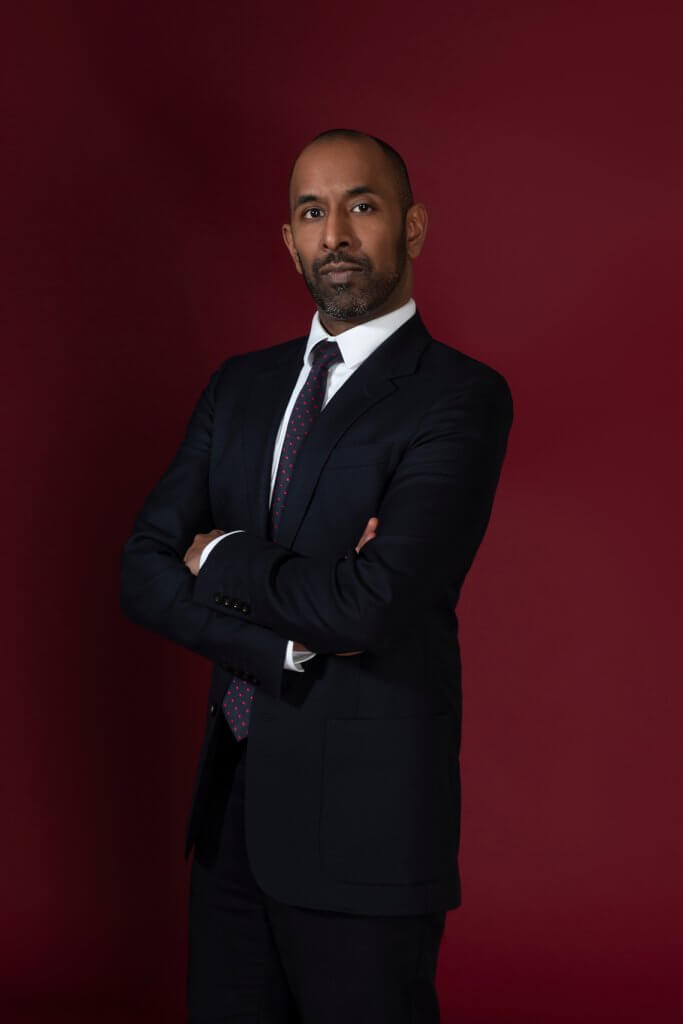

Luke Naylor

Qualification date: 2023

Specialising in:

About

Luke Naylor

Luke is an associate in our corporate and commercial team.

He advises clients on a broad spectrum of company law and corporate practices, including business and company acquisitions and disposals, investments by both majority and minority investors, group reorganisations, and general corporate advisory services. Luke works for a diverse range of clients across a number of sectors, including private companies, individual shareholders and directors, and family offices.

He also assists with work in regulatory and transactional FinTech and financial services.

Luke trained at the firm and qualified in 2023 after studying History and International Relations at Exeter University from 2016-2019 before attending the University of Law to complete his GDL and LPC.

Recognition

Advising a financial research provider

We advised a financial research provider on regulatory issues of offering investment research.

Advising buyer in pre-pack purchase

Advised buyer on the pre-pack purchase of an online business, including a credit bid and broader debt financing.

Assisting Private Equity house on sale of majority shareholding

Assisted Private Equity house on the sale of its majority shareholding in market-leading manufacturer specialising in dual control systems for vehicles. The company, based in the UK but with an expanding European presence, was sold to a Swedish-based group.

Buy and build acquisitions

We acted for a private-equity backed French company in its buy and build acquisitions of multiple UK childcare facilities and the integration of those acquisitions into their group.

Company fundraising

Advising Strive Gaming, the US-focused player account management (PAM) platform, in securing new investment from a number of major gambling industry stakeholders, including OpenBet.

Multi-million-pound acquisition

We acted for a subsidiary of an overseas conglomerate on a multi-million-pound acquisition of a paper production business.

Spotlight

video

Hear what Trainees say about their Training Contract with Collyer Bristow

Hear former Trainees Abbie Armstrong, Debbie Marin and Luke Naylor, share their experiences of training with Collyer Bristow. Now qualified, in this wide ranging interview they discuss openly their journey to applying to Collyer Bristow; the interview process; how Collyer …

Insights, News & Events

View all insights & newsView all eventsView all videos & podcasts

News

Collyer Bristow advises Moulton Goodies on the sale of He-Man Dual ControlsCollyer Bristow advises Moulton Goodies on the sale of He-Man Dual Controls

Read more

News

Nigel Brahams ranked in Chambers FinTech Guide 2026Nigel Brahams ranked in Chambers FinTech Guide 2026

Read more

Shorter Reads

Changes to identity verification – is your company compliant with ECCTA?Changes to identity verification – is your company compliant with ECCTA?

Read more

Shorter Reads

Powering Progress: The UK’s £60M Creative Industries Boost Plans to Elevate the Gaming IndustryPowering Progress: The UK’s £60M Creative Industries Boost Plans to Elevate the Gaming Industry

Read more

News

Collyer Bristow enhances Commercial and IP offering with strategic senior hire, Sarah CoeCollyer Bristow enhances Commercial and IP offering with strategic senior hire, Sarah Coe

Read more

Shorter Reads

Gaming or gambling? The regulation of video game ‘loot boxes’Gaming or gambling? The regulation of video game ‘loot boxes’

Read more

Shorter Reads

‘Promoting the integrity of the register’: The new Companies House approach to non-compliance‘Promoting the integrity of the register’: The new Companies House approach to non-compliance

Read more

Shorter Reads

Are you a member?Are you a member?

Read more

Longer Reads

Secret commissionsSecret commissions

Read more

Longer Reads

Piggy Banks to Portfolios: can children hold shares in a company?Piggy Banks to Portfolios: can children hold shares in a company?

Read more

Longer Reads

ESG: The new FCA Anti-Greenwashing and Sustainability RulesESG: The new FCA Anti-Greenwashing and Sustainability Rules

Read more

Shorter Reads

Cases of de-banking are on the riseCases of de-banking are on the rise

Read more

Review your business documents

Contact us today to find out more about CB Checkpoint and to begin your review.

Quick glance: publications

- Corporate Know-How Guides: Subsidiary v Branch

- Corporate Know-How Guides: Share Classes

- Corporate Know-How Guides: Getting a Business Ready for Sale

- Corporate Know-How Guides: Share Buybacks

- Corporate Know-How Guides: Heads of Terms

- Corporate Know-How Guides: Shareholder Rights

- Financial services seminar slides February 2024

- Corporate Know-How Guides: Share v. Asset Sales

- Corporate Know-How Guides: Shareholders’ Agreements: the Basics

- Corporate Know-How Guides: Selling a Business

Publications

Corporate Know-How Guides: Subsidiary v Branch

Establishing a business presence in the UK can be a transformative step for an overseas company. This guide explores the key differences between setting up a subsidiary or registering a branch, helping you navigate critical considerations like liability, financial reporting, and setup processes. Whether you’re looking to test the UK market or plan a long-term investment, this guide provides clarity on the most suitable structure for your needs.

Discover our latest Corporate Know-How guides.

Corporate Know-How Guides: Share Classes

Creating new share classes can be a useful way of attracting new participants, allowing a company to offer shares that are particularly focussed towards their desired investors. Whether you are considering re-organising the ownership of your business or are keen to understand the most suitable structure for a planned investment, this guide can help you with some common questions in relation to share classes.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Getting a Business Ready for Sale

Prior to approaching the market or agreeing terms with a prospective buyer, undertaking adequate preparations for sale can contribute to a smoother transaction for all parties. In this guide, we look at some key questions to consider in respect of the readiness of a business for a potential sale.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Share Buybacks

Put simply, a share buyback is where a company purchases its own shares from an existing shareholder. In this guide, we will look at some key aspects of share buybacks in relation to private limited companies incorporated in England & Wales.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Heads of Terms

In this guide we will look at heads of terms as they relate to the sale of a business or assets in England & Wales. Whether identified as “heads of terms”, a “letter of intent” or “heads of agreement”, these documents summarise the key terms of a proposed transaction.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Shareholder Rights

Whether you are a minority shareholder concerned about what influence you can exert over a company’s affairs, or a founding shareholder, considering the amount of equity you would be prepared to sell to investors without losing control – this guide is here to help you understand what shareholders can do and when.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Share v. Asset Sales

Share and asset purchases are the two methods of acquiring a business in the UK.

Do you know their differences? The business of a sole trader or unregistered partnership can only be acquired through an asset purchase as there is no owning entity for the assets which can be acquired, while a share purchase can be used for the acquisition of all or part of the shares in a company which owns and operates a business.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Shareholders’ Agreements: the Basics

Did you know that a shareholders’ agreement is a written agreement, between the shareholders of a company, as to the relationship between them and how the company should be managed. By including the company as a party, the shareholders can ensure that it is both bound by and able to enforce the terms of the agreement against contravening shareholders.

Discover our new series of Corporate Know-How guides.

Corporate Know-How Guides: Selling a Business

We look at the flip side of price structuring, instead focusing on how a seller could secure elements of the purchase price that are delayed – or at least obtain comfort around the buyer’s ability to pay them.

Discover our new series of Corporate Know-How guides.

Luke's colleagues

Abbie

Coleman Associate

Specialising in: Banking & financial disputes, Commercial arbitration, Commercial disputes, Corporate recovery, restructuring & insolvency, Financial Services & Trusts & Inheritance disputes

+44 20 7470 4435

+44 7760 805398

Email Abbie

Robin

Henry Partner - Head of Dispute Resolution Services

Specialising in: Banking & financial disputes, Commercial disputes, Corporate recovery, restructuring & insolvency, Financial regulatory, Financial Services & Personal insolvency

+44 20 7470 4429

+44 7943 503198

Email Robin

Qualification 2023

Specialising in...

About

Luke is an associate in our corporate and commercial team.

He advises clients on a broad spectrum of company law and corporate practices, including business and company acquisitions and disposals, investments by both majority and minority investors, group reorganisations, and general corporate advisory services. Luke works for a diverse range of clients across a number of sectors, including private companies, individual shareholders and directors, and family offices.

He also assists with work in regulatory and transactional FinTech and financial services.

Luke trained at the firm and qualified in 2023 after studying History and International Relations at Exeter University from 2016-2019 before attending the University of Law to complete his GDL and LPC.

Recognition

Advising a financial research provider

We advised a financial research provider on regulatory issues of offering investment research.

Advising buyer in pre-pack purchase

Advised buyer on the pre-pack purchase of an online business, including a credit bid and broader debt financing.

Assisting Private Equity house on sale of majority shareholding

Assisted Private Equity house on the sale of its majority shareholding in market-leading manufacturer specialising in dual control systems for vehicles. The company, based in the UK but with an expanding European presence, was sold to a Swedish-based group.

Buy and build acquisitions

We acted for a private-equity backed French company in its buy and build acquisitions of multiple UK childcare facilities and the integration of those acquisitions into their group.

Company fundraising

Advising Strive Gaming, the US-focused player account management (PAM) platform, in securing new investment from a number of major gambling industry stakeholders, including OpenBet.

Multi-million-pound acquisition

We acted for a subsidiary of an overseas conglomerate on a multi-million-pound acquisition of a paper production business.

Spotlight

Hear what Trainees say about their Training Contract with Collyer Bristow

Hear former Trainees Abbie Armstrong, Debbie Marin and Luke Naylor, share their experiences of training with Collyer Bristow. Now qualified, in this wide ranging interview they discuss openly their journey to applying to Collyer Bristow; the interview process; how Collyer …

Insights, News & Events

News

Collyer Bristow advises Moulton Goodies on the sale of He-Man Dual ControlsCollyer Bristow advises Moulton Goodies on the sale of He-Man Dual Controls

Read more

News

Nigel Brahams ranked in Chambers FinTech Guide 2026Nigel Brahams ranked in Chambers FinTech Guide 2026

Read more

Shorter Reads

Changes to identity verification – is your company compliant with ECCTA?Changes to identity verification – is your company compliant with ECCTA?

Read more

Shorter Reads

Powering Progress: The UK’s £60M Creative Industries Boost Plans to Elevate the Gaming IndustryPowering Progress: The UK’s £60M Creative Industries Boost Plans to Elevate the Gaming Industry

Read more

News

Collyer Bristow enhances Commercial and IP offering with strategic senior hire, Sarah CoeCollyer Bristow enhances Commercial and IP offering with strategic senior hire, Sarah Coe

Read more

Shorter Reads

Gaming or gambling? The regulation of video game ‘loot boxes’Gaming or gambling? The regulation of video game ‘loot boxes’

Read more

Shorter Reads

‘Promoting the integrity of the register’: The new Companies House approach to non-compliance‘Promoting the integrity of the register’: The new Companies House approach to non-compliance

Read more

Shorter Reads

Are you a member?Are you a member?

Read more

Longer Reads

Secret commissionsSecret commissions

Read more

Longer Reads

Piggy Banks to Portfolios: can children hold shares in a company?Piggy Banks to Portfolios: can children hold shares in a company?

Read more

Longer Reads

ESG: The new FCA Anti-Greenwashing and Sustainability RulesESG: The new FCA Anti-Greenwashing and Sustainability Rules

Read more

Shorter Reads

Cases of de-banking are on the riseCases of de-banking are on the rise

Read more

Review your business documents

Contact us today to find out more about CB Checkpoint and to begin your review.

Publications

- Corporate Know-How Guides: Subsidiary v Branch

- Corporate Know-How Guides: Share Classes

- Corporate Know-How Guides: Getting a Business Ready for Sale

- Corporate Know-How Guides: Share Buybacks

- Corporate Know-How Guides: Heads of Terms

- Corporate Know-How Guides: Shareholder Rights

- Financial services seminar slides February 2024

- Corporate Know-How Guides: Share v. Asset Sales

- Corporate Know-How Guides: Shareholders’ Agreements: the Basics

- Corporate Know-How Guides: Selling a Business

You are contacting Luke Naylor, Associate.

Subscribe

Please add your details and your areas of interest below

Article contributor

Luke

NaylorAssociate

Specialising in Commercial, Corporate, Financial regulatory, Financial Services and Private equity

Message us on WhatsApp (calling not available)

Please note that Collyer Bristow provides this service during office hours for general information and enquiries only and that no legal or other professional advice will be provided over the WhatsApp platform. Please also note that if you choose to use this platform your personal data is likely to be processed outside the UK and EEA, including in the US. Appropriate legal or other professional opinion should be taken before taking or omitting to take any action in respect of any specific problem. Collyer Bristow LLP accepts no liability for any loss or damage which may arise from reliance on information provided. All information will be deleted immediately upon completion of a conversation.

Close

About

About

Recognition

Recognition

Work

Work

Spotlight

Spotlight

Insights, News

Insights, News

Publications

Publications

Team

Team