Supporting FCA solo-regulated firms prepare for SMCR implementation.

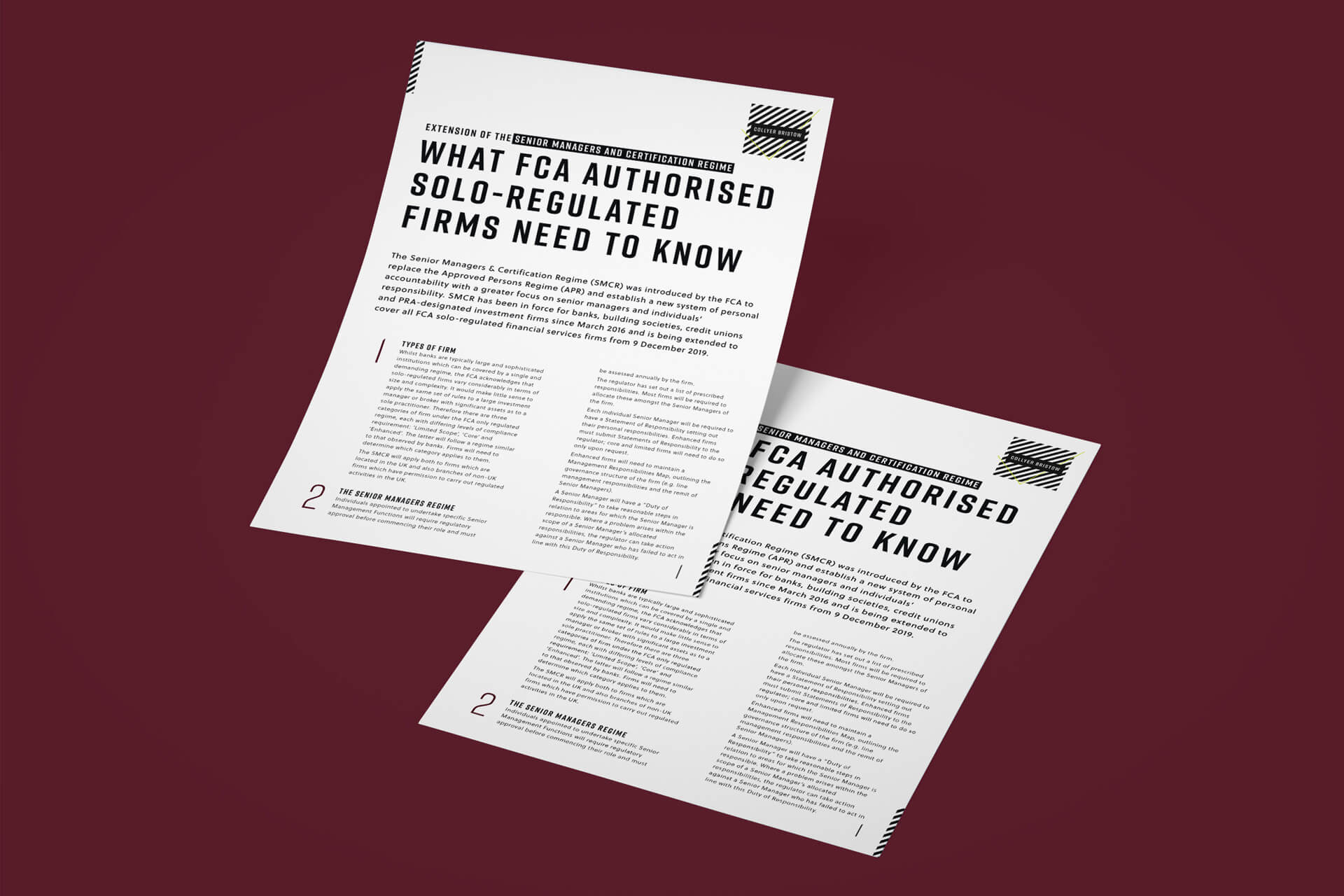

The Senior Managers and Certification Regime (SMCR) was introduced by the FCA on the recommendation of the Parliamentary Commission on Banking Standards, following a review of the 2008 financial crisis.

The FCA was tasked with developing a new system of accountability, a replacement for the Approved Persons Regime, that is more focused on senior managers and individuals’ responsibility. The FCA wants the firms it regulates to operate a ‘culture of accountability’ throughout their organisations, with senior individuals accepting clearly defined and documented responsibilities for which they are personally accountable. The SMCR is the FCA’s drive for greater transparency and integrity within financial services, to mitigate the risk of another market crash and to restore public faith in the industry.

The SMCR has been in force for banks, building societies, credit unions and PRA-designated investment firms (Relevant Authorised Persons) since March 2016 and was extended to cover all FCA (Financial Conduct Authority) solo-regulated financial services firms on 9 December 2019.

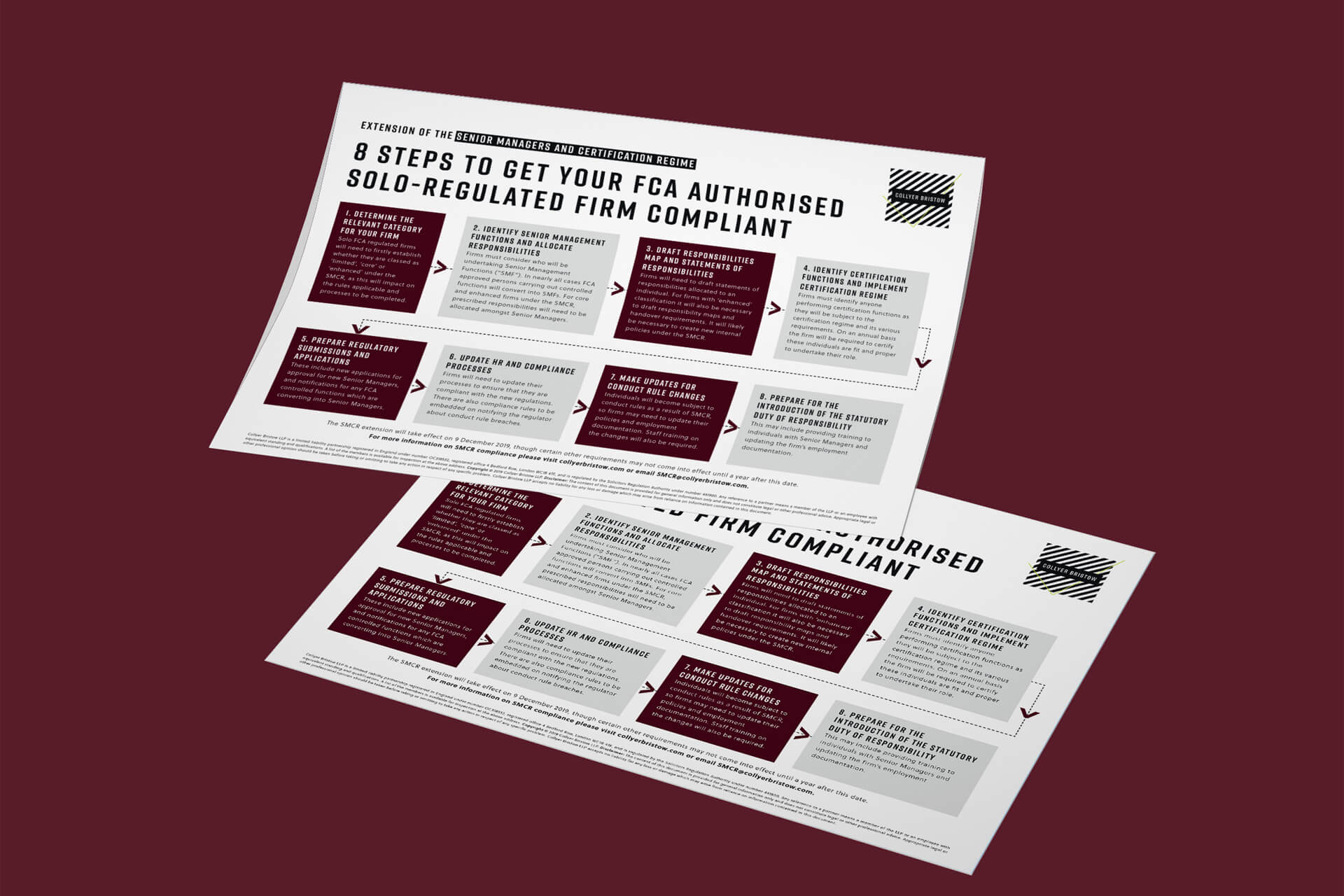

The FCA has acknowledged that there are a range of different types of firm subject to the SMCR, and it is not ‘one size fits all’. As a result there are three categories of firm under the extended SMCR, each with differing levels of compliance requirement: ‘Limited Scope’, ‘Core’ and ‘Enhanced’. Firms need to determine which category applies to them and work to achieve the required level of compliance.

Collyer Bristow’s SMCR team can help with formulating and executing a plan for late implementation covering the key aspects of compliance, notably the regulatory and employment related issues such as:

- Advising on optimisation of existing governance structures

- Helping map current roles into the SMCR

- Identifying key action points for implementation teams

- Advising on interpreting and applying the new rules and guidance

- Assisting in practical use of the transitional provisions and identify any necessary applications

- Reviewing existing policies to identify potential gaps

- Where appropriate, providing template documentation

- Delivering ongoing bespoke training at our office or in-situ

- Assisting in creating specialist in-house training programme suitable for each audience

- Advising on the employment implications and consequential drafting

- Drafting handbooks for affected staff

- Assessing ongoing compliance

See below to download our guides supporting you in achieving SMCR compliance.

Read more