- Banking & financial disputes

- Financial services

- Real estate finance

- Financial services

Longer Reads

Libor transition and loans – what borrowers in the real estate market need to know

As financial markets move away from using LIBOR, Janine Alexander and Audrey Favreau outline the key things that borrowers should be aware of.

5 minute read

Published 29 January 2020

Key information

- Specialisms

- Real Estate

- Sectors

- Financial services

The London Interbank Offer Rate (LIBOR) is the benchmark reference rate commonly used in commercial loans to calculate interest payments in variable (floating) rate loans. LIBOR is now being phased out meaning significant changes for the loan and interest rate swap markets are imminent and this will have significant implications for real estate finance in relation to both ongoing and future financing arrangements.

Following the large scale LIBOR fixing scandal exposed in 2011, and a general decline in the importance of interbank lending within the financial markets, the Financial Conduct Authority (FCA) has indicated that it wants to move the financial markets away from using LIBOR as a benchmark in favour of using instead risk free rates (RFRs) which are based on actual transaction data and so less susceptible to manipulation by the end of 2021.

The FCA announced in July 2017 that it will no longer compel or encourage banks to provide quotations for LIBOR after the end of 2021 and told market participants that they should therefore plan a transition to alternative rates based firmly on actual transactions data before then.

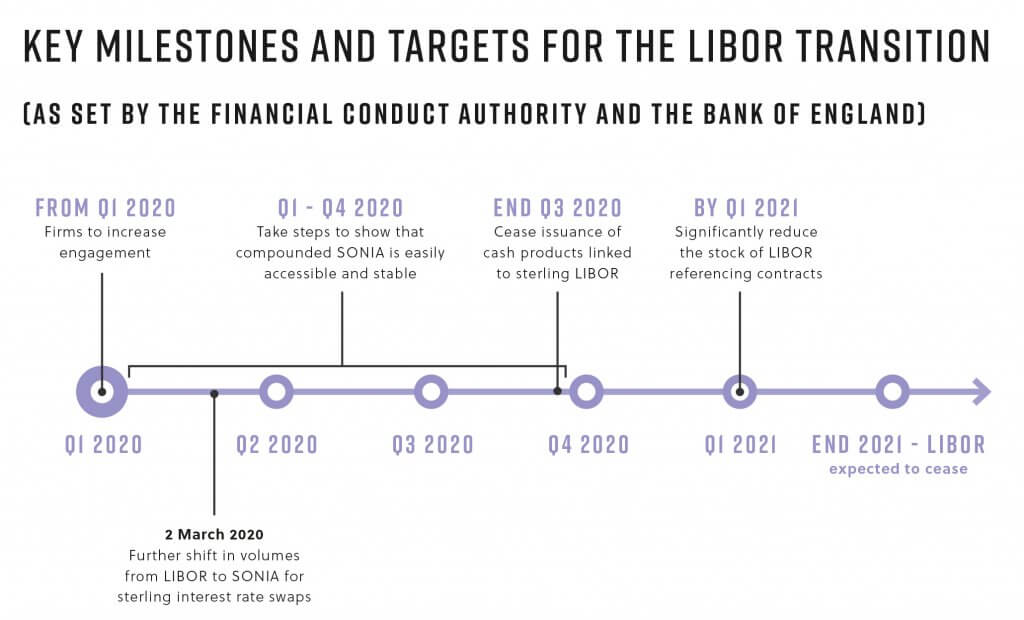

The Bank of England (BoE) and the Working Group on Sterling Risk Free Reference Rates (the Working Group) recently released a suite of documents which outline key milestones and targets in 2020 for the transition from GBP LIBOR to the SONIA risk free rate. These include:

- To take steps to enable a shift from GBP LIBOR to SONIA in the derivative markets by 2 March 2020;

- To cease issuance of GBP LIBOR-base cash products that mature beyond end-2021 by end of Q3 2020; and

- To establish a clear framework to manage transition of legacy LIBOR products to significantly reduce the stock of GBP LIBOR-referencing contracts by end of Q1 2021.

Differences between RFRs and LIBOR

Each currency of LIBOR has its own existing alternative RFR identified by the relevant working groups.

| Currency | Risk-Free Rate | Administrator | Working Group |

|---|---|---|---|

| Sterling | SONIA (Sterling Overnight Index Average) |

Bank of England | Bank of England Working Group on Sterling Risk-Free Reference Rates |

| US Dollar | SOFR (Secured Overnight Funding Rate) |

Federal Reserve Bank of New York | Alternative Reference Rates Committee |

| Euro | €STR (Euro Short-Term Rate) |

European Central Bank | Working Group on Euro Risk-Free Rates |

| Swiss Franc | SARON (Swiss Averaged Rate Overnight) |

SIX Swiss Exchange | Swiss National Working Group |

| Japanese Yen | TONA (Tokyo Overnight Average Rate) |

Bank of Japan | Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks |

There are differences between RFRs and LIBOR which are significant especially for the loan market. As a result, in comparison to other markets such as the derivative markets, there has not yet been many transactions referencing RFRs in the loan market.

The fundamental difference is that existing RFRs are based on historical transaction data and so (unlike LIBOR) there is no element of “forward looking” to the expected movements in interest rate market over the interest period built into the rate. The practical and commercial effect of this is that where interest rate payments are referenced to RFRs, such as SONIA, borrowers can expect loans to be offered on terms where the borrower has less notice as to the interest payments that will be due. The reason for this is that RFRs will likely be calculated at or shortly before the date when payment is due, rather than at the beginning of the interest period (as is usual for LIBOR loans). Therefore, it will no longer be clear well in advance what will be payable. Consequently, some market participants have delayed transition plans awaiting the development of a forward looking RFR term rate.

However, although many currency jurisdictions are looking at developing a forward-looking RFR term rate, the timeline for forward-looking term rates is uncertain and forward-looking term rates may not be made available in all currencies. Regulators are therefore advising market participants that forward-looking RFR term rates should not be relied upon through the transition process and are strongly encouraging market participants to prepare operationally for loans which do not fix the interest rate in advance, and instead “compound in arrears”.

Compounding in arrears means that the interest rate is calculated towards the end of the interest period, by reference to the actual RFRs experienced in that period. As a result, the borrower only knows the amount due towards the end of the interest period. This is in contrast to LIBOR loans, where the borrower knows the interest rate (and therefore the interest due) at the start of the interest period.

To provide at least some notice to assist in managing cash flow for borrowers, the approach to date has been to calculate interest costs with a reference rate lag period of a few days.

What does this mean for borrowers with new loans?

Borrowers in the real estate market should make sure they understand the financial and practical implications of the interest payment mechanisms and benchmarks proposed, in particular:

- Which benchmark rate is proposed and how and when will the payment be calculated?

- Is there a mechanism to change to a forward looking RFR if one is developed?

- Is any short-term interest rate hedging required? This may be needed, for example, to ensure sufficient cash will be available if payment is required on short notice in a volatile interest rate environment.

- How will any repayment or prepayment fee be calculated if the loan is repaid/prepaid before the interest due for the period has been established?

- If there is interest rate hedging associated with the loan, is the interest rate hedge documented “back to back” or is there any remaining exposure?

- If the loan agreement includes a provision allowing the interest mechanism or benchmark to be altered, does any hedging arrangement include a similar provision?

What does this mean for borrowers with existing loans?

There is a further uncertainty in relation to existing loans referencing LIBOR that mature beyond 2021 (legacy contracts). The market clearly anticipates that new loans referencing RFRs will be made before there is a wholesale move in legacy contracts from LIBOR to RFRs.

A key transition issue is the economic difference between the RFRs and LIBOR. LIBOR accounts for credit risk, whereas RFRs (even compounded over a period) only include a nominal element of credit spread. RFRs will therefore be lower than LIBOR. Therefore, switching from LIBOR to an RFR creates an economic differential that must be addressed.

The Working Group has published a consultation on credit adjustment spread methodologies for fallbacks in cash products referencing GBP LIBOR. Feedback has been requested on the consultation paper by 6 February 2020. In due course, the proposed LMA documentation is expected to include a spread adjustment formula to bridge this gap.

Real estate borrowers with legacy contracts should consider the following:

- What will be the contractual position after 2021 based on their loan agreement(s) as drafted?

- Is there a fallback provision specifying an alternative benchmark/ mechanism to LIBOR? Does the fallback provision apply in this situation?

- Is the fallback / alternative commercially acceptable as a permanent basis for the loan going forward? Such provisions include a variety of mechanisms including using the lender’s own cost of funds as the benchmark, allowing the lender to specify an alternative rate or even using the last LIBOR “screen rate” available (which in this situation converts a floating rate loan to a fixed rate loan).

- What happens if LIBOR continues to be published but because of the transition and discontinuance of most bank’s submissions it does not reflect market pricing (so called “Zombie LIBOR”)? Would this trigger the fallback provision / a right for the borrower to change to another rate?

- Can the lender amend the benchmark rate without borrower consent? If not, the lender is likely to seek to include such a right in advance of 2021. Borrowers should therefore carefully review any proposed amendments to their loan agreements which give the lender the right to change the rate without borrower consent (or otherwise change the position that agreement is required). Such amendments may be proposed as part of any wider, unrelated amendments or restructurings.

- If there is interest rate hedging associated with the loan do the fallback mechanisms match? Mismatches in the benchmark used after 2021 between an interest rate swap and the underlying loan creates exposure to the difference between the rates and may lead to additional cost and/or exposure.

What borrowers should do now

Understanding and planning for the impact on your business is key. Despite the current lack of a new reference rate there are steps you can be taking now to prepare:

• Identify loan agreements based on LIBOR which are due to mature after 2021 (and any associated interest rate hedging).

• Understand what fallback mechanisms are contained in these agreements, and which parties must consent to replace LIBOR with an alternative rate.

• Consider whether the position under your current loan documentation will be commercially acceptable to you when LIBOR is discontinued (or becomes a rate which does not reflect the market rate for lenders’ cost of funds, i.e. “Zombie LIBOR”. If you consider the position commercially acceptable, wait for the lender to approach you with any proposals and consider carefully with legal and specialist financial advisors the economic effect of those proposals.

Be alert for proposed amendments allowing the lender to change the rate without consent in advance of proposals as to a new reference rate. If the contractual position as drafted is not commercially acceptable, seek to negotiate an amendment with the lender to specify a rate acceptable to both parties, with pricing adjusted as necessary on a negotiated basis to avoid “value transfer”. Alternatively, agree a mechanism to deal fairly with selecting a new rate when the position is clearer overall in 2021. The strength of the borrowers’ negotiating position will depend on the individual circumstances.

It may be that engagement as to the new reference rate is not possible until close to the discontinuation. However, waiting for the lender to raise this issue without assessing the available options and their commercial impact risks being underprepared for negotiations with the lender. It may also leave no time to investigate refinance options if the lender is not prepared to agree a sensible solution.

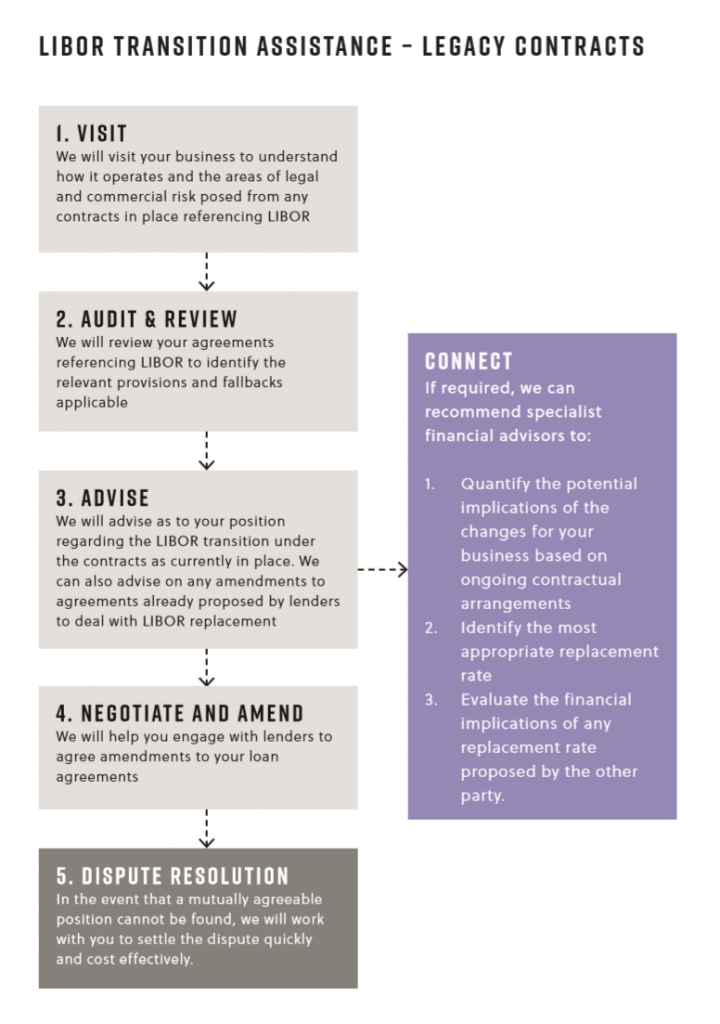

How Collyer Bristow can help

We can advise you on the implications for your contracts which reference LIBOR. We are able to review your contracts to assess the effect that the discontinuance of LIBOR will have on the agreement and to enable you to consider whether the terms are still commercially acceptable or require renegotiation. For borrowers with extensive financing arrangements we can offer a tailored service to assist with the process of assessing and managing LIBOR transition, working with you to make sure the extent of the risk/exposure for the business is understood in good time and mitigated as effectively and efficiently as possible.

Details of our process are set out below:

Related content

Longer Reads

Libor transition and loans – what borrowers in the real estate market need to know

As financial markets move away from using LIBOR, Janine Alexander and Audrey Favreau outline the key things that borrowers should be aware of.

Published 29 January 2020

Associated sectors / services

The London Interbank Offer Rate (LIBOR) is the benchmark reference rate commonly used in commercial loans to calculate interest payments in variable (floating) rate loans. LIBOR is now being phased out meaning significant changes for the loan and interest rate swap markets are imminent and this will have significant implications for real estate finance in relation to both ongoing and future financing arrangements.

Following the large scale LIBOR fixing scandal exposed in 2011, and a general decline in the importance of interbank lending within the financial markets, the Financial Conduct Authority (FCA) has indicated that it wants to move the financial markets away from using LIBOR as a benchmark in favour of using instead risk free rates (RFRs) which are based on actual transaction data and so less susceptible to manipulation by the end of 2021.

The FCA announced in July 2017 that it will no longer compel or encourage banks to provide quotations for LIBOR after the end of 2021 and told market participants that they should therefore plan a transition to alternative rates based firmly on actual transactions data before then.

The Bank of England (BoE) and the Working Group on Sterling Risk Free Reference Rates (the Working Group) recently released a suite of documents which outline key milestones and targets in 2020 for the transition from GBP LIBOR to the SONIA risk free rate. These include:

- To take steps to enable a shift from GBP LIBOR to SONIA in the derivative markets by 2 March 2020;

- To cease issuance of GBP LIBOR-base cash products that mature beyond end-2021 by end of Q3 2020; and

- To establish a clear framework to manage transition of legacy LIBOR products to significantly reduce the stock of GBP LIBOR-referencing contracts by end of Q1 2021.

Differences between RFRs and LIBOR

Each currency of LIBOR has its own existing alternative RFR identified by the relevant working groups.

| Currency | Risk-Free Rate | Administrator | Working Group |

|---|---|---|---|

| Sterling | SONIA (Sterling Overnight Index Average) |

Bank of England | Bank of England Working Group on Sterling Risk-Free Reference Rates |

| US Dollar | SOFR (Secured Overnight Funding Rate) |

Federal Reserve Bank of New York | Alternative Reference Rates Committee |

| Euro | €STR (Euro Short-Term Rate) |

European Central Bank | Working Group on Euro Risk-Free Rates |

| Swiss Franc | SARON (Swiss Averaged Rate Overnight) |

SIX Swiss Exchange | Swiss National Working Group |

| Japanese Yen | TONA (Tokyo Overnight Average Rate) |

Bank of Japan | Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks |

There are differences between RFRs and LIBOR which are significant especially for the loan market. As a result, in comparison to other markets such as the derivative markets, there has not yet been many transactions referencing RFRs in the loan market.

The fundamental difference is that existing RFRs are based on historical transaction data and so (unlike LIBOR) there is no element of “forward looking” to the expected movements in interest rate market over the interest period built into the rate. The practical and commercial effect of this is that where interest rate payments are referenced to RFRs, such as SONIA, borrowers can expect loans to be offered on terms where the borrower has less notice as to the interest payments that will be due. The reason for this is that RFRs will likely be calculated at or shortly before the date when payment is due, rather than at the beginning of the interest period (as is usual for LIBOR loans). Therefore, it will no longer be clear well in advance what will be payable. Consequently, some market participants have delayed transition plans awaiting the development of a forward looking RFR term rate.

However, although many currency jurisdictions are looking at developing a forward-looking RFR term rate, the timeline for forward-looking term rates is uncertain and forward-looking term rates may not be made available in all currencies. Regulators are therefore advising market participants that forward-looking RFR term rates should not be relied upon through the transition process and are strongly encouraging market participants to prepare operationally for loans which do not fix the interest rate in advance, and instead “compound in arrears”.

Compounding in arrears means that the interest rate is calculated towards the end of the interest period, by reference to the actual RFRs experienced in that period. As a result, the borrower only knows the amount due towards the end of the interest period. This is in contrast to LIBOR loans, where the borrower knows the interest rate (and therefore the interest due) at the start of the interest period.

To provide at least some notice to assist in managing cash flow for borrowers, the approach to date has been to calculate interest costs with a reference rate lag period of a few days.

What does this mean for borrowers with new loans?

Borrowers in the real estate market should make sure they understand the financial and practical implications of the interest payment mechanisms and benchmarks proposed, in particular:

- Which benchmark rate is proposed and how and when will the payment be calculated?

- Is there a mechanism to change to a forward looking RFR if one is developed?

- Is any short-term interest rate hedging required? This may be needed, for example, to ensure sufficient cash will be available if payment is required on short notice in a volatile interest rate environment.

- How will any repayment or prepayment fee be calculated if the loan is repaid/prepaid before the interest due for the period has been established?

- If there is interest rate hedging associated with the loan, is the interest rate hedge documented “back to back” or is there any remaining exposure?

- If the loan agreement includes a provision allowing the interest mechanism or benchmark to be altered, does any hedging arrangement include a similar provision?

What does this mean for borrowers with existing loans?

There is a further uncertainty in relation to existing loans referencing LIBOR that mature beyond 2021 (legacy contracts). The market clearly anticipates that new loans referencing RFRs will be made before there is a wholesale move in legacy contracts from LIBOR to RFRs.

A key transition issue is the economic difference between the RFRs and LIBOR. LIBOR accounts for credit risk, whereas RFRs (even compounded over a period) only include a nominal element of credit spread. RFRs will therefore be lower than LIBOR. Therefore, switching from LIBOR to an RFR creates an economic differential that must be addressed.

The Working Group has published a consultation on credit adjustment spread methodologies for fallbacks in cash products referencing GBP LIBOR. Feedback has been requested on the consultation paper by 6 February 2020. In due course, the proposed LMA documentation is expected to include a spread adjustment formula to bridge this gap.

Real estate borrowers with legacy contracts should consider the following:

- What will be the contractual position after 2021 based on their loan agreement(s) as drafted?

- Is there a fallback provision specifying an alternative benchmark/ mechanism to LIBOR? Does the fallback provision apply in this situation?

- Is the fallback / alternative commercially acceptable as a permanent basis for the loan going forward? Such provisions include a variety of mechanisms including using the lender’s own cost of funds as the benchmark, allowing the lender to specify an alternative rate or even using the last LIBOR “screen rate” available (which in this situation converts a floating rate loan to a fixed rate loan).

- What happens if LIBOR continues to be published but because of the transition and discontinuance of most bank’s submissions it does not reflect market pricing (so called “Zombie LIBOR”)? Would this trigger the fallback provision / a right for the borrower to change to another rate?

- Can the lender amend the benchmark rate without borrower consent? If not, the lender is likely to seek to include such a right in advance of 2021. Borrowers should therefore carefully review any proposed amendments to their loan agreements which give the lender the right to change the rate without borrower consent (or otherwise change the position that agreement is required). Such amendments may be proposed as part of any wider, unrelated amendments or restructurings.

- If there is interest rate hedging associated with the loan do the fallback mechanisms match? Mismatches in the benchmark used after 2021 between an interest rate swap and the underlying loan creates exposure to the difference between the rates and may lead to additional cost and/or exposure.

What borrowers should do now

Understanding and planning for the impact on your business is key. Despite the current lack of a new reference rate there are steps you can be taking now to prepare:

• Identify loan agreements based on LIBOR which are due to mature after 2021 (and any associated interest rate hedging).

• Understand what fallback mechanisms are contained in these agreements, and which parties must consent to replace LIBOR with an alternative rate.

• Consider whether the position under your current loan documentation will be commercially acceptable to you when LIBOR is discontinued (or becomes a rate which does not reflect the market rate for lenders’ cost of funds, i.e. “Zombie LIBOR”. If you consider the position commercially acceptable, wait for the lender to approach you with any proposals and consider carefully with legal and specialist financial advisors the economic effect of those proposals.

Be alert for proposed amendments allowing the lender to change the rate without consent in advance of proposals as to a new reference rate. If the contractual position as drafted is not commercially acceptable, seek to negotiate an amendment with the lender to specify a rate acceptable to both parties, with pricing adjusted as necessary on a negotiated basis to avoid “value transfer”. Alternatively, agree a mechanism to deal fairly with selecting a new rate when the position is clearer overall in 2021. The strength of the borrowers’ negotiating position will depend on the individual circumstances.

It may be that engagement as to the new reference rate is not possible until close to the discontinuation. However, waiting for the lender to raise this issue without assessing the available options and their commercial impact risks being underprepared for negotiations with the lender. It may also leave no time to investigate refinance options if the lender is not prepared to agree a sensible solution.

How Collyer Bristow can help

We can advise you on the implications for your contracts which reference LIBOR. We are able to review your contracts to assess the effect that the discontinuance of LIBOR will have on the agreement and to enable you to consider whether the terms are still commercially acceptable or require renegotiation. For borrowers with extensive financing arrangements we can offer a tailored service to assist with the process of assessing and managing LIBOR transition, working with you to make sure the extent of the risk/exposure for the business is understood in good time and mitigated as effectively and efficiently as possible.

Details of our process are set out below:

Associated sectors / services

- Banking & financial disputes

- Financial services

- Real estate finance

- Financial services

Need some more information? Make an enquiry below.

Enjoy reading our articles? why not subscribe to notifications so you’ll never miss one?

Subscribe to our articlesMessage us on WhatsApp (calling not available)

Please note that Collyer Bristow provides this service during office hours for general information and enquiries only and that no legal or other professional advice will be provided over the WhatsApp platform. Please also note that if you choose to use this platform your personal data is likely to be processed outside the UK and EEA, including in the US. Appropriate legal or other professional opinion should be taken before taking or omitting to take any action in respect of any specific problem. Collyer Bristow LLP accepts no liability for any loss or damage which may arise from reliance on information provided. All information will be deleted immediately upon completion of a conversation.

Close