- Private Wealth

- Wills & Succession Planning

Shorter Reads

How will the Autumn Statement impact inheritance tax

The wish to pass something on to your children may be the most basic, human and natural aspiration there is, but if inheritance tax was designed to be paid by just the very rich, it isn’t any more.

1 minute read

Published 18 November 2022

Key information

- Specialisms

- Private Wealth

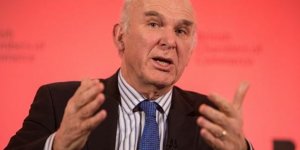

The Chancellor’s announcement today that inheritance tax nil rate bands are to remain frozen until April 2028 means many who have that aspiration will have to contribute more, so that in that catchy phrase of Mr Hunt: we do not leave our debts to the next generation.

The inheritance tax nil rate band (NRB) threshold is currently £325,000. It has been fixed at that level since 6 April 2009 and, before today’s announcement, was already set to sit at £325,000 until April 2026. The NRB is worth up to £130,000 to the personal representatives of people who have died, individuals and trustees. That is what it was worth in April 2009 and that is what it will be worth at least until 2028. Had the NRB gone up at the same rate as inflation, in line with the consumer prices index (CPI), it might have been around £465,000 in April 2023 and worth nearly £190,000.

The residence nil rate band (RNRB) threshold and the RNRB taper are currently £175,000 and £2 million. Before today’s announcement they were also set to stay where they are until April 2026.

Until this year the average rate of inflation was around 2.1%. The Office for Budget Responsibility forecast the UK’s inflation rate to be 9.1% this year, 7.4% next year. At these rates, the value of the NRB and RNRB will be of concern to a very significant number of households by 2028.

The government will legislate for these measures in Autumn Finance Bill 2022.

Read more information on our Wills & Succession planning page.

These comments were first published on LexisNexis in November 2022.

Related content

Shorter Reads

How will the Autumn Statement impact inheritance tax

The wish to pass something on to your children may be the most basic, human and natural aspiration there is, but if inheritance tax was designed to be paid by just the very rich, it isn’t any more.

Published 18 November 2022

Associated sectors / services

The Chancellor’s announcement today that inheritance tax nil rate bands are to remain frozen until April 2028 means many who have that aspiration will have to contribute more, so that in that catchy phrase of Mr Hunt: we do not leave our debts to the next generation.

The inheritance tax nil rate band (NRB) threshold is currently £325,000. It has been fixed at that level since 6 April 2009 and, before today’s announcement, was already set to sit at £325,000 until April 2026. The NRB is worth up to £130,000 to the personal representatives of people who have died, individuals and trustees. That is what it was worth in April 2009 and that is what it will be worth at least until 2028. Had the NRB gone up at the same rate as inflation, in line with the consumer prices index (CPI), it might have been around £465,000 in April 2023 and worth nearly £190,000.

The residence nil rate band (RNRB) threshold and the RNRB taper are currently £175,000 and £2 million. Before today’s announcement they were also set to stay where they are until April 2026.

Until this year the average rate of inflation was around 2.1%. The Office for Budget Responsibility forecast the UK’s inflation rate to be 9.1% this year, 7.4% next year. At these rates, the value of the NRB and RNRB will be of concern to a very significant number of households by 2028.

The government will legislate for these measures in Autumn Finance Bill 2022.

Read more information on our Wills & Succession planning page.

These comments were first published on LexisNexis in November 2022.

Associated sectors / services

- Private Wealth

- Wills & Succession Planning

Need some more information? Make an enquiry below.

Enjoy reading our articles? why not subscribe to notifications so you’ll never miss one?

Subscribe to our articlesMessage us on WhatsApp (calling not available)

Please note that Collyer Bristow provides this service during office hours for general information and enquiries only and that no legal or other professional advice will be provided over the WhatsApp platform. Please also note that if you choose to use this platform your personal data is likely to be processed outside the UK and EEA, including in the US. Appropriate legal or other professional opinion should be taken before taking or omitting to take any action in respect of any specific problem. Collyer Bristow LLP accepts no liability for any loss or damage which may arise from reliance on information provided. All information will be deleted immediately upon completion of a conversation.

Close